Simpler is Not Always Better: The Community Bank Leverage Ratio Playbook

How to Calculate and Defend Your Own Capital Requirement Using Stress Testing

Background

The Federal Deposit Insurance Corporation on Sept. 17 finalized the Community Bank Leverage Ratio (“CBLR”). Community banks with less than $10 billion in assets can opt into the new capital framework and forego risk-based capital rules as long as they maintain at least a 9 percent Tier 1 leverage ratio.

The rule is a byproduct of S.2155 (aka “the Crapo bill”), adopted in 2018 to roll back much of the Dodd-Frank Act. The bill called for regulators to create a new simpler capital framework for community banks, with a CBLR between 8 and 10 percent. Predictably, the regulators settled on the midpoint of that range. The CBLR is on track to go into effect on January 1, 2020. Since banks will use their Call Reports to report their capital levels, the framework will first be available on March 31, 2020.

Banks that opt into the CBLR and remain above the 9 percent threshold would no longer be required to comply with the “Basel III” capital rules, or even calculate their risk-based capital ratios. Touted as easing the regulatory burden, the new framework will primarily free community banks from the paperwork hassle of calculating these ratios.

However, this will come at a severe – yet hidden cost – to shareholders. Using the Invictus BankGenome™ intelligence system, we calculated that 96 percent of community banks could justify a leverage ratio requirement of less than 9 percent. A $1 billion bank that can support a customized capital requirement of 8 percent would be burning $10 million of capital to the ground simply by opting into the CBLR.

Fiduciary Responsibility to Know Your Bank

Every community bank is unique. Each operates in a discrete footprint with its own strategy. The composition and risk characteristics of their assets are distinct. Their income streams, cost structures, and efficiencies are different. Yet any one-size-fits-all approach to capital adequacy such as the CBLR will be based upon the lowest common denominator bank. It’s no coincidence that examiners often tell banks they must hold a minimum Tier 1 capital ratio of at least 9 percent. That is the fall back, de facto level.

The management team of every community bank must take it upon itself to calculate the minimum capital requirement commensurate with the bank’s risk profile. Blindly opting in to the CBLR is a disservice to shareholders. At the same time, if a community bank decides NOT to opt in to the CBLR, it must be prepared to support and defend that requirement to its board of directors and regulators. Choosing not to opt into the CBLR but not having a customized capital requirement calculated and backed by data and analytics is also unacceptable. It will give your regulator cause for concern because you do not have strong command over how your capital is allocated.

To be frank, even if your regulator ignores or doesn’t accept your calculation, management’s job is to not go down without a fight. Simply bemoaning that your regulator won’t be willing to have such a conversation is no excuse for not having one. That’s weak, short-sighted and a disservice to your shareholders. And in our experience, regulators will listen – and they will look at documentation you provide to make your case.

Stress Testing – The Right Tool for the Job

So how does a community bank go about calculating its own capital requirement? The only answer is stress testing. To understand why that’s the case, it is critical to examine how the fallout from the 2008 Financial Crisis transformed the very definition of capital adequacy in the banking system.

In a nutshell, regulators deployed three primary tools to force banks to hold more capital in reaction to the Financial Crisis:

- They implemented new capital rules in 2015 (often referred to as ‘Basel III’ since it was the means in which U.S. regulators went about applying the accord). The rules redefined capital and risk-weighted assets in a manner that was more restrictive, increased the prompt-corrective action guidelines (i.e. minimum thresholds) from prior levels, and introduced new concepts such as the capital conservation buffer. Net net, the overall impact of the Basel III capital rules resulted in a significant increase in bank capital requirements.

- They approve or reject the capital plans of the nation’s largest banks using the results of the Comprehensive Capital Analysis and Review (“CCAR”) stress testing program, an annual exercise in which the Federal Reserve prescribes a two-year severe recession that looks and smells like the 2008 Financial Crisis all over again. A CCAR bank is not permitted to pay dividends or buy back stock without first passing a stress test that includes such capital actions, irrespective of its intention to move forward with them if another recession occurs.

- Regulators do not use the same approach with community banks. There are simply too many of them and they collectively represent too small a percentage of assets in the banking system. Instead, it’s far easier for regulators to utilize a ‘one-size-fits- all’ approach – unless a community bank makes a case for its own capital requirement.

Although the Basel III rules tightened capital requirements for community banks (the written rules), individual examiners continue to communicate to community banks that they expect them to hold levels of capital well-above the written minimums (the unwritten rules). This is especially true for community banks with significant concentrations of capital in construction, commercial real estate and agricultural loans. Often these unwritten expectations are somewhere between 8 percent to 10 percent on the Tier 1 Leverage Ratio. Sound familiar? This is the same range that the Crapo bill authorized regulators to work within to determine the CBLR. In other words, the CBLR is formalizing what has already been happening in the community bank industry for years. Unfortunately, many banks have been ill-prepared to defend themselves against this expectation. And many others simply rolled over, despite the importance of freeing up every possible penny of capital to generate enough ROE to ensure their independence.

All these regulatory tactics are designed to ensure that banks have a sufficient capital buffer to absorb another severe recession, irrespective of the likelihood of it occurring. Therefore, the only way to possibly calculate an individual bank’s unique capital requirement in a post-2008 world is by analyzing how the bank would perform under another severe recession. The only tool that does this effectively is a robust, forward-looking stress test that both quantifies the impact of stress on capital across a bank’s entire balance sheet and business, but also is based upon the unique risk characteristics of the bank’s assets, predominantly its loans.

The Significance of the Stress Capital Buffer (“SCB”)

The CCAR stress tests are the only close-to-genuine attempt by regulators to craft individual capital requirements. As controversial, arduous, and expensive as the CCAR stress tests are, they provide a lens for the largest banks to ‘tell their story’ about their risk profile and how it affects capital.

The CCAR stress tests essentially force the large banks to create a Stress Capital Buffer (“SCB”) as the key component of their capital requirement. The SCB is added to the minimum requirement for passing the stress test to calculate a bank’s customized capital requirement. For example, if Bank X has 9 percent Leverage Ratio capital today, but their capital drops to 6 percent in a severe recession, their SCB would be 3 percent. The 3 percent buffer is added to the 4 percent regulatory minimum of passing the stress test, giving the bank a customized capital requirement of 7 percent. Since Bank X has 9 percent today, their excess capital would be 2 percent, which they can use for growth, dividends, stock repurchases, etc.

The regulators have been using the CCAR stress tests as the centerpiece to customize capital requirements for the nation’s largest banks on a de facto basis since 2012, but last year they proposed to formalize this moving forward. The movement to formalize the SCB has been led by Vice Chairman Randal Quarles, who earlier this month elaborated more on the SCB.

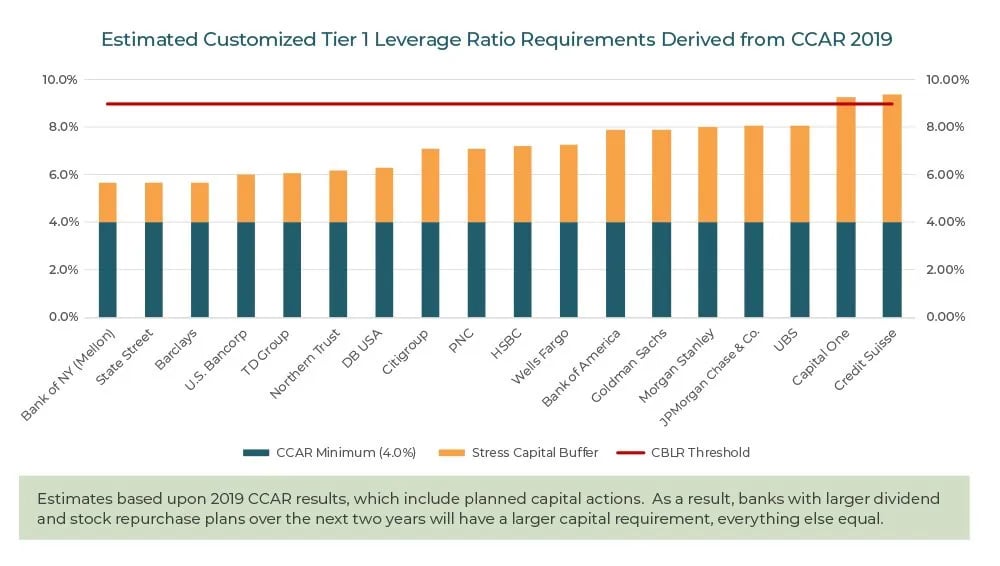

An analysis of the estimated Tier 1 Leverage Ratio requirements for the large banks using the results of last year’s CCAR stress tests shows startling results. Of the 18 banks, 16 can justify leverage ratio requirements less than 9 percent, as this graphic shows:

Using Big-Bank Tools to Get Results

For community banks, the solution is simple. Stress test your bank and calculate your own SCB and ultimately your own capital requirement. Community banks must realize that stress testing is the perfect weapon to control their own capital requirements. Yes, CCAR is designed for large banks, not community banks. However, community banks need to quit looking at stress testing as simply a check-the-box exercise to please their regulators or to adhere to the 2006 interagency guidance on managing CRE concentrations.

By taking this approach, community banks will be pleasantly surprised to discover that their regulators will often respond positively. For the regulators, it’s all about trust. Can they trust a given bank to properly manage its capital? In defense of regulators, how can the answer possibly be yes if a given bank can’t even estimate its own capital requirement or support it with data?

Most community bank regulators will be receptive to a customized capital requirement, even if they are not trained in stress testing, under three conditions:

- The bank is genuinely using stress testing to help create and manage their strategic and capital plans. In other words, the bank is not just running a stress test to appease the regulators. The regulators’ conscious or subconscious litmus test will be “would this bank be using stress testing even if it were not regulated?” The answer needs to be yes. Banks cannot fake this. They need to embrace stress testing, or it will never work, no matter how much money, quants, or data they throw at the exercise.

- The stress tests CANNOT be a black box that management does not understand. Do not purchase a model from a vendor without understanding how it works, or what the results mean, and then hand a report to the regulators and say, “here is my stress test”. Management does not need to be experts in stress testing, but they do need to have a strong understanding of how their stress test works, why the methodologies utilized are appropriate, and how their inputs (loan-level information) translate into outputs (ultimately their customized capital requirement).

- The stress tests must be forward-looking, driven by loan-level information, and able to be validated. Simply using your historical loss experience from the Great Recession or the 75th percentile worst bank is insufficient. The heart and soul of a bank’s vulnerability to stress will be credit risk embedded within the loan portfolio. It is crucial to utilize loan-level information that contains these risk characteristics to drive the loan portfolio stress test component of your capital stress test. It is the only way to perform forward-looking analysis. Validation is also important to regulators, so make sure your model is designed in such as fashion that it’s easy to do so. Validation should also be important to you because if you are adhering to condition #1, you want to make sure you are relying on a model that you can trust.

An Autopsy on Community Bank Stress Testing Over the Last 10 Years

We are nearly in 2020, and by now, most community banks are using some form of stress testing. However, while they are often checking the box with regulators, most are also not doing so in a manner that can be used sufficiently for calculating capital requirements and figuring out whether to opt into the CBLR. Below is a list of the most common shortfalls we see with community bank stress tests:

- They are only stress testing their loans. They cannot connect the results to the impact on capital because they are not stressing the rest of their balance sheet or their earnings.

- In many cases, only the CRE loans are being stress tested. Residential mortgages and consumer loans are not included. The irony is that many banks will find they are most vulnerable to losses within the C&I portfolio under stress due to the ‘soft’ nature of the collateral, but they are not stressing those, either.

- They are performing capital stress tests, but they are shortcutting the calculation for loan loss provisions and net charge-offs by using historical losses from their own bank or other banks, or by applying some multiple to their net charge-offs in ‘good times’. What they are missing is a forward-looking analysis using loan-level information. Today’s loans were originated under completely different economic and interest rate conditions than loans that were on the books in 2008. Underwriting philosophies and standards have also changed. This all gets completely missed with a ‘look back’ approach that is used simply to plug in a number.

- They are sending ‘flat files’ to a vendor and getting a report back in return, but don’t understand the report or use it to make any real decisions about their strategic or capital plans.

- They are unable to incorporate planned actions such as loan growth, dividends, stock repurchases, mergers and acquisitions, or investments in new business lines into their stress tests.

- Stress testing is being done in a vacuum and is the sole responsibility of either the Chief Credit Officer or Chief Financial Officer, but there is little to no collaboration across various departments within the bank.

- Stress tests may be done on a recurring basis, but each stress test is its own mutually exclusive exercise with zero trend analysis. What community banks often miss is that the most valuable insights from stress testing are unlocked from performing trend analysis across previous stress tests.

- Stress testing is an imperfect exercise. It is not and never will be a proverbial crystal ball. However, if the same general test is performed over multiple periods, then changes in the results from one period to the next are screaming to tell you a story. The most important result, perhaps, is the capital requirement estimated for a given bank. But this is not a static number. A given bank’s capital requirement will change over time as its loan portfolio turns over, as its earnings model changes, as its mix of assets and liabilities fluctuates, etc. Has the stress loss rate on the CRE-non-owner-occupied portfolio increased or decreased versus the prior analysis? And why?

- Stress testing as described above is insufficient. Certain loan-only stress tests provide valuable insights for underwriting and monitoring individual loans, but are virtually useless for strategic and capital planning, which are top-down exercises. Community banks will need to do more than they are doing now to properly use their stress tests to determine their own unique capital requirements.

- Community banks need to take the next step with respect to stress testing. They need to run CCAR-style stress tests and fill in the above-mentioned gaps, if applicable. Most community bankers brave enough to have read this whitepaper to this point are gasping right now, asking themselves: How are we going to do something that is this complex? How much will it cost?

This type of stress testing is not that difficult nor expensive. Most community banks have much simpler business models than the large money center banks, which often include international operations, investment banking, and massive off-balance sheet derivative exposures. Most community banks gather deposits and make loans, and that is their primary business. Some may have additional revenue streams such as loan sales of mortgages and SBA loans, wealth management, and loan servicing, but these are not overly complex business models, either. Most community banks have plain vanilla securities portfolios, so analyzing those aren’t too difficult.

Community banks are also in a better position today to ensure the stress testing of their loan portfolio is forward-looking and using loan-level information. This is because they (hopefully) are at some sort of stage in the process of preparing for CECL.

A 60-Day Turn-key Solution

Invictus Group has crafted a 60-day roadmap to help community banks quickly run a CCAR-style stress test for the quarter ending either June 30, 2019 or September 30, 2019, backed by its loan-level information. The following timeline illustrates how easily and quickly this can be done:

- 9/30 – Kickoff meeting to discuss data requirements, timeline, and introduce team members.

- 10/1 – Bank staff downloads loan-level data file from core processing system and uploads to secure portal.

- 10/8 – Bank staff and Invictus team complete any ‘work through’ of the loan-level information to make sure it’s being properly understood, translated and validated.

- 10/22 – Invictus team completes development, customization, and operation of an initial draft of a CCAR-style stress test for the selected period using our proprietary BankGenome™ technology platform. Draft analyses, including a high-level board report, supporting backup schedules, pro forma financial statements, a list of critical assumptions, and a loan-level stress test report, are provided to the bank staff. The reports include a calculation of the bank’s customized capital requirement, and an analysis of that result compared with the CBLR of 9 percent.

- 10/25 – Invictus team members meet with bank management to walk through the reports. This meeting leads to action items on both sides to further fine-tune the analysis and its presentation.

- 10/29 – Invictus team members meet with bank management a second time. The purpose of this meeting is to walk through exactly how the stress test works from the ‘ground up’. This should eliminate any perception of the analysis being a ‘black box’ while also giving bank management the confidence to both trust and own the analysis. This meeting may also lead to additional fine-tuning of the analyses.

- 11/5 – An updated draft of all reports that reflect the agreed-upon adjustments from the previous meeting are provided by Invictus to bank management.

- 11/12 – Final reports are issued by Invictus to bank management.

- 11/19 – Invictus works with bank management to make any necessary adjustments to the bank’s formal capital plan using the results of the stress test. This includes the customized capital requirements and a recommendation on whether to adopt the CBLR.

- 11/19 – Invictus and bank management present the results of the stress test, proposed changes to the capital plan, and recommendation on whether to adopt the CBLR to either the Risk or ALCO committee of the board of directors. The results are presented with a ‘medium level’ of detail to give committee members the information necessary to further vet the analysis on behalf of the entire board.

- 11/26 – Invictus and bank management present everything to the entire board of directors. Acting as stewards of the bank’s capital, directors will ask questions, and document the discussion in the minutes of the meeting. The board then passes the necessary resolutions that formalize the changes to the bank’s capital plan as well as a decision regarding the CBLR.

- TBD – Invictus works with the bank to prepare the necessary materials in advance of the bank’s next safety and soundness exam with regulators.

- Early / Mid-2020 – The process is repeated for the period ending either December 31, 2019 or March 30, 2020 to re-assess the bank’s capital requirements. Trend analysis versus the original analysis is performed to extract critical insights that can be used for risk management, capital planning, and strategic decision-making.

The above timeline can obviously be modified as necessary to fit your bank’s schedule. To a certain extent, there is no rush to decide on the CBLR by January 1, 2020 since banks can opt in or out at any time. However, the sooner community banks jump on this exercise, the sooner they can free up their capital so it can be used for strategic purposes.

Acting now also makes sure the bank sets the right precedent; changing course after January 1 can technically be done at any time, but in reality, the bank will need to explain, support, and defend any changes with its stakeholders. As with just about everything in life, getting it right up front will make it far easier moving forward.

Wrap Up: Don’t Miss the Opportunity

In many ways, the decision regarding the CBLR provides a tremendous opportunity for community banks. They can use this process to support and defend a customized capital requirement. It allows them to put a stake in the ground with their regulators, so they do not have to succumb to a rule-of-thumb that was ultimately based on the lowest common denominator bank.

Banks that do nothing or blindly opt into the new framework risk encumbering unnecessary capital that can be used to drive shareholder value and ensure their ongoing independence in a world where generating the appropriate levels of ROE is becoming increasingly difficult.

By our calculations, $44 billion may be at stake.

The CBLR is an inflection point for community banks.

Many community banks have the raw materials (data) and talent to do this type of stress testing. They must analyze the impact on the entire bank and perform forward-looking analysis on the loan portfolio using loan-level data.

Please contact me if you would like to discuss this further. Our stress testing team can schedule your bank for the 60-day solution immediately.

Adam Mustafa is the Chief Executive Officer of the Invictus Group.

For more information about the Invictus Group’s advisory services, please email gcallas@invictusgrp.com