The Biggest CECL Mistake Most Banks will Make — and How to Avoid It

CECL Trends

Five years from now, every bank will have undergone at least one full year under the current expected credit loss (CECL) standard, and most public banks will have three years under their belts. Best practices will begin to emerge, and so will the biggest blunders.

Mistakes will be very expensive; the price to pay will include wasted shareholder value from grossly excessive loan loss reserves, unnecessary expenditures and needless time on implementing the wrong system, and ultimately, the need to start over to get it right. For community banks, these CECL mistakes will cost many millions of dollars, with multiples even higher for larger banks.

So why wait five years to find out what not to do? The CECL implementation travesty that appears to be unfolding for many banks can be avoided.

The Critical Misstep

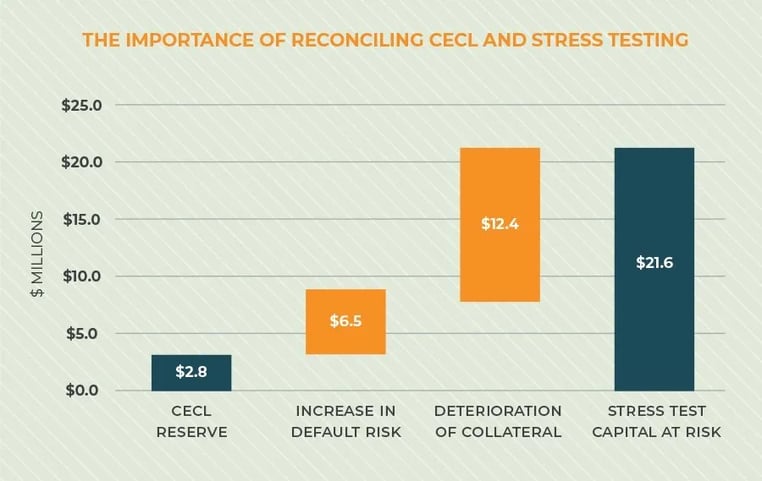

The biggest mistake banks will make is the failure to integrate CECL with stress testing and other critical functions such as loan underwriting, loan pricing, strategic planning, and even M&A analytics. However, stress testing will be the match that lights the fire.

Stress testing has emerged as a critical function for community banks, particularly for those with commercial real estate and agricultural concentrations, and for acquisitive banks. As banks grow and cross various size thresholds, the bar is raised in terms of regulatory expectations for the use of stress testing for risk management, capital planning and strategic planning.

Five years from now, every bank will have undergone at least one full year under the current expected credit loss (CECL) standard, and most public banks will have three years under their belts. Best practices will begin to emerge, and so will the biggest blunders.

Mistakes will be very expensive; the price to pay will include wasted shareholder value from grossly excessive loan loss reserves, unnecessary expenditures and needless time on implementing the wrong system, and ultimately, the need to start over to get it right. For community banks, these CECL mistakes will cost many millions of dollars, with multiples even higher for larger banks.

So why wait five years to find out what not to do? The CECL implementation travesty that appears to be unfolding for many banks can be avoided.

Stress testing is becoming as important as asset/liability modeling, which took a similar path to becoming a functional mainstay for the banking system when it started in the early 1990s. Federal Reserve Chairman Jerome Powell testified in March that supervisory stress testing “is the most successful regulatory innovation of the post-crisis era.”

Stress testing analytics have evolved over the last eight years. The old days of running the “20/200” loan-level stress tests (those that assume a 20 percent decline in Net Operating Income and 200 percent increase in capitalization rates) are over. That type of analysis, while helpful for loan underwriting and credit monitoring purposes, has proven to be both difficult and useless for capital and strategic planning.

So why is it so important for stress testing and CECL to be integrated? Because they are the same analysis — if done correctly.

CECL and Stress Testing Similarities

Both CECL and stress testing should be using the same raw loan-level information as inputs, and they should be utilizing the same analytical techniques to perform the calculations. The ONLY difference between a CECL calculation and a stress test should be the economic scenario that is assumed. And even that assumption might not always be different. When — and if — there is a downturn, the economic scenario for CECL and a bank’s stress test would be identical, and therefore the results should be identical.

This pitfall for banks will first emerge when a regulator or auditor starts comparing a bank’s CECL calculation with its stress test. They will want to understand the variance, and they will expect management to be able to clearly explain the difference.

The auditors and regulators will not only use this as a way to validate the CECL calculation, they will also use it as a litmus test to evaluate management’s capabilities from a capital planning and risk management perspective.

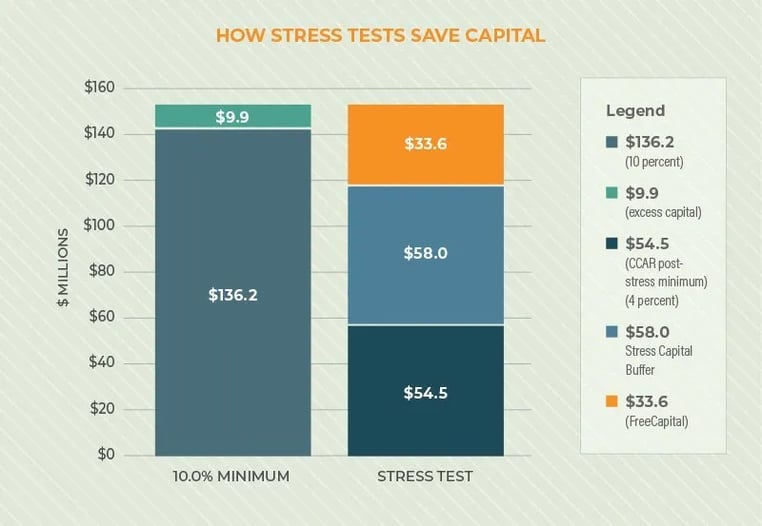

Those C-Suite teams that explain these variances with command are far more likely to be trusted by regulators to manage their institutions with elevated concentration levels, to grow via acquisitions, and to obtain the highest ‘M’ score on CAMELS ratings. In fact, the smartest banks will not even view this as a compliance exercise; they understand that the new calculator of capital adequacy in a post-2008 world is a stress test. They will be running stress tests to help decide how to allocate capital to maximize risk/reward and return on capital.

Think of it this way: CECL calculates expected losses, and the stress test calculates unexpected losses. It makes no sense to calculate those two numbers with different methods. The only way bank management can understand the variances between CECL and stress testing is to perform those calculations under the same roof with the same data and the same methods.

Choosing the Right Approach

The CECL guidance makes a variety of methods available for compliance. However, there is one method that is far superior to the other methods with respect to its applicability to both CECL and stress testing — and that is the Probability of Default/Loss-Given Default (PD/LGD) methodology. This method lends itself best to leveraging loan-level information, which is the key to both CECL and stress testing.

The reason that leveraging loan-level information is so vital is because it is the best, if not only way, to perform forward-looking analysis, which is what underpins both the spirit of CECL and stress testing. You can link risk rating, debt service coverage ratios, time-to-maturity, structure, and credit scores to probability of default. You can link loan-to-value, collateral codes, and vintage to loss-given-default.

Some of the simpler methodologies that can be used to implement CECL, such as the open-pool and closed-pool methods, are useless for stress testing because they are too focused on historical losses on yesterday’s loans and not forward-looking analysis on today’s loans.

Some in the industry will also make a case for the discounted cash flow (DCF) method. The DCF method is certainly better than the open-pool, closed-pool, and vintage methods, and can be used for both CECL and stress testing.

However, the DCF method is dependent on two critical assumptions: the default rate and the recovery rate. Sound familiar? The default rate is the same as probability of default and the recovery rate is the inverse of loss-given default. In other words, if you are going to have a DCF that is worth its salt, you need to have a capable PD/LGD methodology in place as a prerequisite. Even with a PD/LGD methodology embedded into it, a DCF methodology brings a plethora of complications and challenges that the elegance of a stand-alone PD/LGD methodology avoids.

Benefits of the PD/LGD Method

The PD/LGD methodology also lends itself perfectly for other functions such as loan underwriting, loan pricing, strategic planning, and M&A. At the end of the day, all of these functions should utilize the same basic information — a bank’s loan and deposit level data. They should all talk to each other and feed one another. The PD/LGD method is the most portable to these other processes because of its unique blend of simplicity, natural alignment to credit analysis, and ability to leverage loan-level data.

Now is the time to take the right approach with CECL.

Many banks will make the unfortunate mistake of choosing a CECL methodology and stress testing analysis that have nothing in common, and can’t work together. By 2023 or sooner, they’ll have to start over when regulators and auditors start asking them to explain the gaps between their CECL calculations and their stress tests.

Banks should integrate their CECL methodology with stress testing at the start, which will give a bank’s risk management processes the flexibility to adapt to critical areas such as loan underwriting, loan pricing, strategic planning, and even M&A analytics.

Integration must be a prerequisite for any CECL solution a bank considers. Taking this approach today will save banks from a tremendous amount of unnecessary pain and hardship over the next five years. It will give banks ammunition and credibility to defend their CECL calculations and preserve shareholder value, while avoiding succumbing to the ‘peer group’ card that regulators and auditors will ultimately play.

For more information about the Invictus Group’s CECL services, please email gcallas@invictusgrp.com