The Regulatory Push for Community Bank Climate Change Risk Management

Introduction

Make no mistake about it: Bank regulators, members of Congress, and other financial overseers are concerned about the impact of climate change on banks of all sizes. And they want banks to do something about it.

The OCC has made climate risk management a top priority. In the first move of its kind by any U.S. banking regulator, the OCC named Darrin Benhart, a seasoned safety and soundness supervisor, as climate risk officer in July 2021, reporting to the Senior Deputy Comptroller for Supervision Risk and Analysis.

Acting Comptroller of the Currency Michael J. Hsu said in a March 7, 2022 speech that climate change is a safety and soundness issue, not a political one, for banks. In other words, this is an issue that won’t disappear with a new administration.

The FDIC and the Federal Reserve have indicated they will work with the OCC to come up with detailed future climate risk management guidance for all banks. While the current focus is on larger banks, Hsu said the OCC will eventually require climate risk management exams for mid-size and community banks. He suggests that those banks get ready ahead of time.

“My suggestion to those bankers has been simple: Use the time wisely,” Hsu said. “To the extent that midsize and community banks can develop thoughtful, tailored assessments of their climate risk profiles, they will help mitigate the risk of a “trickle down” of large bank climate risk management expectations in the future.”

In a February 2022 webinar sponsored by the Alliance for Innovative Regulation, Benhart said many mid-sized and community banks are just beginning to think about “where do I start in this space.”

This white paper offers some ideas.

How to Prepare for Climate Risk Management

Bank regulators refer to two types of risk from climate change:

- The physical risks to property or people from extreme weather or changes in climate.

- Transition risks, stemming from extra stress on financial institutions due to climate change-related changes in policy, consumer or business behavior, or technology.

A Commodity Futures Trading Commission subcommittee report in 2020 singled out community banks as being especially vulnerable to climate change physical risks because of their concentrations in commercial real estate.

When regulators refer to physical risk from climate change, they are including damage to property, infrastructure, and business disruptions due to acute, climate-related events, such as hurricanes, wildfires, floods, and heatwaves, and chronic shifts in climate, including higher average temperatures, changes in precipitation patterns, sea level rise, and ocean acidification,” the FDIC said in April when it published its “Statement of Principles for Climate Related Financial Risk Management for Large Financial Institutions.”

Regulators view climate change as a safety and soundness issue because damage from physical risks could affect the value of property securing bank loans, as well as borrowers’ ability to repay their obligations.

The SEC has already issued a proposal for mandatory climate risk disclosures from public companies, which would help standardize metrics that could help banks assess climate risks from their customers.

It seems likely that physical risk is the type of risk that community banks should consider first when coming up with a climate risk management framework. Minimally, community banks will need specialized weather data, risk measurements, and the ability to assess the impact of climate change on their local communities, and ideally, their loan portfolios.

“Clearly, community banks are going to have to grapple with these issues,” said Amy Friend, a former senior OCC deputy comptroller and chief counsel, during the February Alliance for Innovative Regulator webinar. She noted that physical risks to community banks “could be tremendous” and pose “existential issues” in the future.

Know Your Footprint

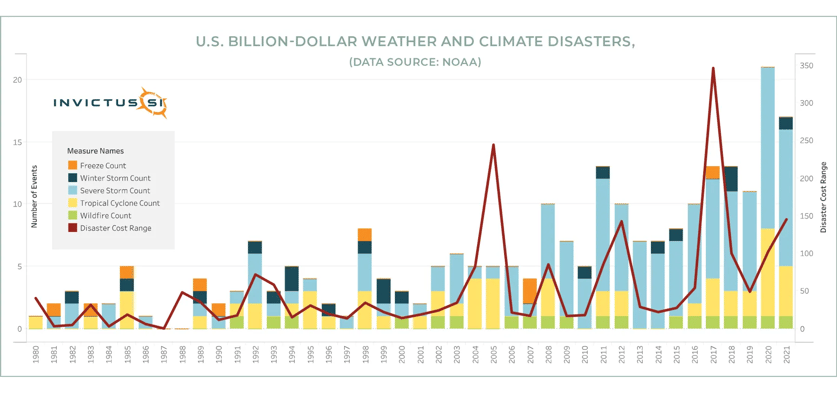

Extreme weather events are becoming more frequent and more severe in terms of their impact. This matters for community banks, not only for protecting the value of the properties they lend to today but also in the leading role they must play in building the infrastructure for tomorrow. The chart below shows the frequency of extreme weather events that have resulted in more than a billion dollars of damage in the United States:

Community banks are creatures of their geographic footprints. To develop a climate risk management framework, community banks will need to understand the makeup of their footprint and how their loan portfolio intersects with it. The biggest issue for most banks will be in building a bridge between scientific data and financial data.

This will require accessing data on climate risks, industries, polluters, and weather events, and mapping that information to your geographic market so you can get a sense of your potential extreme weather risk and subsequent potential losses.

Ideally, community banks would be able to then make strategic decisions based on the climate-related risks of loans in their portfolio.

Five Questions to Ask

Every bank board should ask five basic questions about climate risk, moving the “climate conversation from the offices of scientists, policymakers, and regulators to bank boardrooms,” Comptroller Hsu recommended in a speech last November. Although these five questions were aimed at large banks, community banks would be wise to tailor them to their own circumstances and risk profiles.

- What is our overall exposure to climate change?

- Which counterparties, sectors, or locales warrant our heightened attention and focus?

- How exposed are we to a carbon tax?

- How vulnerable are our data centers and other critical services to extreme weather?

- What can we do to position ourselves to seize opportunities from climate change?

Using the questions to start building a climate risk management framework can position your community bank as an industry leader. And it can also help your bank begin to focus on environmental, social and governance issues, which are becoming increasingly important to investors, employees, and regulators.

Scenarios and Stress Tests

Stress testing has become a key tool in the regulatory and larger bank risk management arsenal. Banks use stress testing to understand what could happen to their capital under various scenarios, which helps them gauge whether their strategic moves make financial sense.

Climate change risks, however, require a longer time frame than is typically used for stress testing. Regulators and others are developing climate change models with longer time frames and external scientific data. In the meantime, community banks and others can still conduct scenario analyses.

“Banks can and should engage in what I call ‘small s’ scenario testing — that is, asking more granular ‘what if?’ questions that directly affect parts of a bank’s portfolio. For banks with strong risk management capabilities, this is bread-and-butter stuff,” Hsu said.

Stress testing was also mentioned in the September 2020 CFTC report, “Managing Climate Risk in the U.S. Financial System.” The report concluded that regional and community banks were “more vulnerable to regionally concentrated physical risk, including to sudden extreme events” than larger banks, mainly because their commercial real estate-heavy portfolios were more geographically concentrated. The report also expressed concern about the impact on low-to-moderate income and marginalized communities that are often served by community banks.

The report recommended that regulators work with banks of all sizes to “pilot climate risk stress testing” by testing balance sheets against scenarios over specified time horizons. The report suggested that bank regulators “research the impact of climate risk on financial system assets and liabilities, including by sensitivity of specific sectors to climate change, geographic location, and tenor. In doing so, regulators should identify data gaps and approaches to address these shortcomings. “

Banks that are on the forefront of climate risk management will “not only be better prepared to withstand climate change events but will also have a better line of sight into the many business opportunities that will arise,” Hsu said.

“Just as strong credit risk management capabilities can provide the assurance and confidence needed for a bank to make risky credit decisions prudently, strong climate risk management capabilities can enable the same prudent risk taking with regards to climate-related business opportunities. The better a car’s brakes, the faster you can safely drive it,” he said.

Challenges for Community Banks

While global regulators are discussing climate risk scenarios and yet-to-be-developed climate risk stress testing for the largest banks, community banks may want to begin with simpler tools to assess their climate risks.

The biggest problem facing community banks will be a lack of in-house expertise, data, time, and money to develop the kind of tools regulators will require when it comes to climate analytics.

Financial data will not be enough. They will need to incorporate external scientific data about weather and other environmental factors, such as the prevalence of greenhouse gas emissions in their footprint, to truly understand their own vulnerabilities.

Some community banks are worried that any regulatory requirements will harm their ability to serve their communities. The Independent Community Bankers of America published a paper last year that said it would oppose most climate-related regulation, including limits on lending to fossil fuel or carbon-intensive industries, climate change stress testing, mandatory disclosures, or capital requirements based on climate risks.

Ironically, some reports have noted that community banks — including agriculture banks in the Midwest — are most susceptible to climate change and are already experiencing long-term impacts from severe flooding, drought, and tornadoes.

“Many agricultural banks are small and highly exposed to impacts that reduce farmers’ ability to service their debts, including climate-exacerbated extreme weather events,” the CFTC report concluded, noting that more than 70 percent of nonperforming agriculture loans in the Midwest were on community bank balance sheets.

Where to Start: Invictus Climate Analytics

Community banks can read between the lines. They know they need to start somewhere when it comes to climate risk management. They may already be feeling pressure from shareholders, customers, or examiners, even if it’s just in passing.

Bankers can begin by collecting and monitoring data and keeping abreast of policy changes that may affect them or their customers in the future. They also need to have a good grasp of their geographic footprint and its vulnerabilities to physical risk. They should analyze their portfolio on a quarterly basis so they can start to observe trends, which will give them a road map on where to go next, and what questions they’ll need to answer.

There’s no pressure — yet — to make any changes to their banks based on what their data tells them.

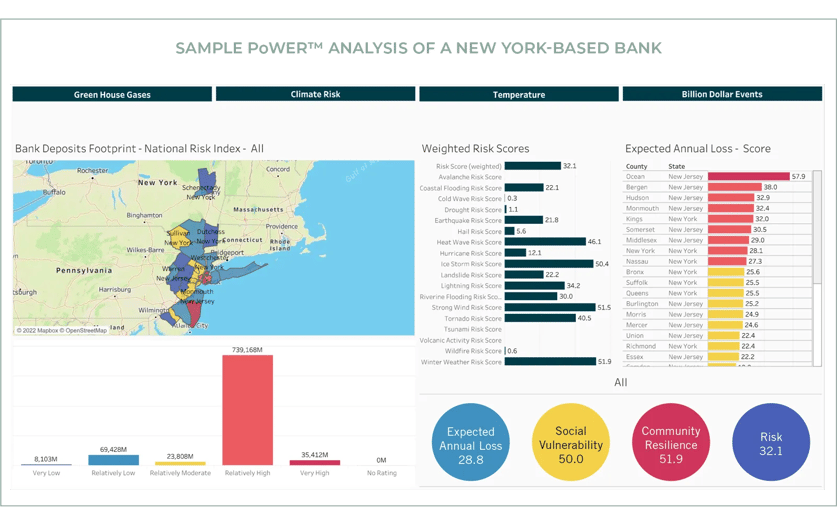

Invictus has developed a simple suite of climate risk analytics that community banks can use as a starting point. These initial analytics will provide community banks insights into the physical risks their banks may face from climate change, as well as help launch valuable discussions in the boardroom and with bank examiners.

Using loan-level data, the Portfolio Weather Event Risk Analysis (PoWER)™ maps specific climate risks to geographic markets and displays them visually, allowing the C-Suite, boards, shareholders and regulators to see the potential impact.

Further Reading

FDIC, Statement of Principles for Climate Related Financial Risk Management for Large Financial Institutions, April 2022

SEC, The Enhancement and Standardization of Climate-Related Disclosures for Investors, March 2022

OCC, Principles for Climate-Related Financial Risk Management for Large Banks, December 2021

CFTC subcommittee, Managing Climate Risk in the U.S. Financial System, September 2020

If you are interested in viewing this new product, please contact Avik Ray, Invictus Director of Climate Analytics, at aray@invictusgrp.com for more information.