Why Hidden Trends Mandate a New Approach for CEOs and Boards

The Strategic Case for M&A

The post-recession environment, coupled with a radically different monetary policy, has had both an obvious and hidden impact on community bank operating and financial performance. Banks have learned to live with these issues, and some have even thrived.

But all the while, covert damage to their balance sheets has accumulated. It has been hiding in plain sight in bank assets and liabilities, masked by traditional financial reporting and ignored by most market analysts.

Unfortunately, the expected and inevitable rising rate environment will expose this harm, blindsiding most bank management, investors and shareholders. The purpose of this article is to highlight these troubling issues and focus on viable, preemptive actions.

How We Got Here

The Federal Reserve implemented its post-recession federal monetary policy using its primary weapon – market rates. Practically exhausting all the bullets in its arsenal, the Fed maintained extremely low rates for much of the last decade. This quantitative easing created and maintained the extended low interest rate environment, pumping unprecedented levels of funds into the marketplace. As a result, it drastically increased the deposit base in the U.S. This strategy has created an interesting push-pull impact on community bank performance.

Declining gross loan yields have been offset by declining cost of funds (primarily deposits) and an increase in the supply of these deposits. During this extended post-recession period, net interest margins (NIMs) have remained relatively strong, creating a pattern of reasonable earnings, year after year. Analysts that rely on traditional financial statements have blindly accepted these trends, continuing to extrapolate these NIMs into the expected rising rate environment.

The Perfect Storm

Unfortunately, a storm is brewing, and bank earnings are in its path. When QE reverses and interest rates rise, banks will start to get hit by the damage that has already quietly poisoned their balance sheets.

This becomes obvious when one looks at the following factors that will come into play as rates begin to rise.

On the asset side:

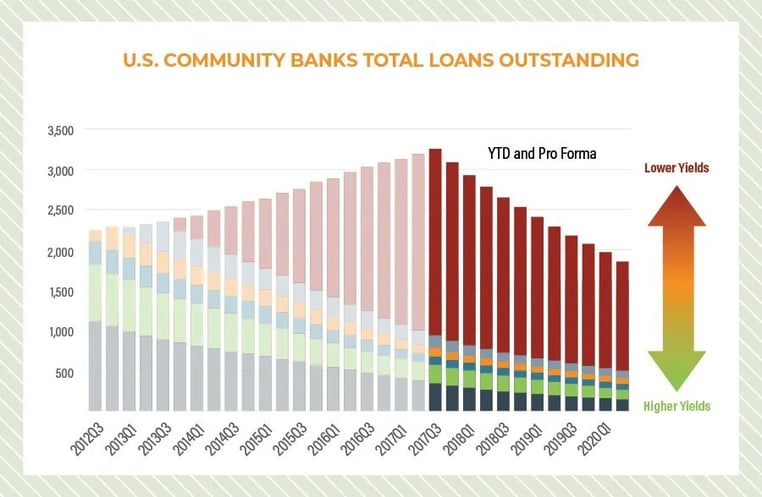

- Bank asset portfolios are loaded with record low gross yields.

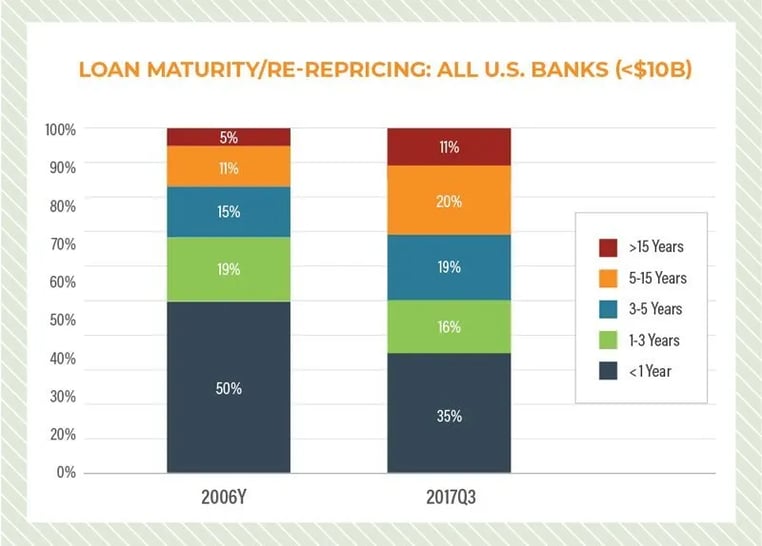

- Bank portfolios are increasingly biased toward fixed-rate and longer-term loans.

Even assuming an annual portfolio turnover of approximately 17 percent – the estimated community bank average, according to Invictus Group data —community banks will suffer substantially reduced future gross margins, as these low yielding assets continue to dominate banks’ balance sheets for some time to come. The differences in the timing of increases in asset and liability costs will cause short periods of NIM improvement, but the long-term trends will be negative for the majority of banks.

Community banks will continue to feel the effects of the Fed’s low rate policy while the lower yielding loans originated over the past four to five years remain on the books.

On the liability (deposits) side:

- Deposit costs will increase as a whole, compared with assets that will increase their gross yields at a rate linked to their turnover rate.

- The eventual reversal of quantitative easing will suck deposits out of the banking market, increasing upward pressure on cost of funds.

- Over time, a steeper yield curve will shift community bank demand deposits toward expensive deposit instruments.

- The institution of the liquidity coverage ratio as a component of capital adequacy on DFAST banks will create a much more competitive environment for relatively lower cost deposits than has been seen in prior rising rate periods.

These issues will inevitably result in a substantial increase in community bank cost of funds, especially if banks are forced to tap into alternative sources of funding.

The combined impact of these factors on bank performance paints a rather bleak picture for future bank P&Ls. Unfortunately, other factors will further exacerbate this situation.

- It will likely take between three to five years for bank portfolios to significantly purge these low yielding assets.

- Existing traditional analytical tools and methodologies cannot predict, quantify or provide reasonable solutions to this highly unusual community banking environment. Most research analysts are clueless; as evident by current research reports that are silent on these trends.

Factors to Weigh

As the Fed continues to debate the timing of changes, community banks have some time to take appropriate actions. It is essential that bank executives and boards realize that they need to alter their mindset in critical areas.

Many banks will attempt to use the ALCO process to mitigate these trends. Unfortunately, ALCO is primarily a short-term tuning process, not a long-term strategic tool. It Is not designed to solve long-term gross yield and cost of funds issues. Given that the “Normalization Period” will extend for several years, corrective actions using ALCO may serve to further aggravate the long-term situation.

Community banks need to focus on methods designed to meaningfully change the mix, rate and duration flexibility of their asset portfolios. They must also recognize that deposits, whose availability and pricing have been taken for granted for several years, will be of increasing importance in the years to come.

Community banks need to be prepared to move away from their dependence on traditional analytics that cannot identify, quantify and provide solutions to these unprecedented problems in the U.S. community banking market.

Every CEO and board member knows that strategic planning is essential to making sure their bank has the right tools to maneuver their bank through unexpected obstacles. Yet many community banks are not including a potential merger or acquisition scenario in their strategic planning exercises.

Solutions

Given the slow turnover rate of loan portfolios, any meaningful change in a bank’s assets and their composition by type, rate and maturity can only be accomplished through the M&A process. Similarly, improving loan-to-deposit ratios and deposit composition can only be meaningfully accomplished through M&A.

Unfortunately, there is no guarantee that an appropriate target exists, or if it exists, that it is available for sale at the appropriate price. However, it is imperative that bank management explore this possibility thoroughly before resigning themselves to more traditional and less effective approaches to solving the upcoming problems.

Banks that successfully use M&A in an appropriate manner have an extraordinary opportunity to separate themselves from the pack.

For banks that are prepared to explore the M&A option, CEOs and boards should realize that times have changed.

Traditional M&A valuation techniques and dependence on ratios such as multiple-to-book and payback period are no longer relevant and generally misleading.

It is necessary to analyze in depth, not only the fixed and floating interest rates built into a target’s loan portfolio, but also the individual duration and maturities of their loan portfolios as they extend into the future. Traditional accounting systems tend to obscure this critical data, and the commonly used extrapolations of GAAP financial statements generally lead to misleading and erroneous conclusions.

The increasing value of deposits needs to be quantified in the appropriate manner. Again, traditional techniques for valuing deposits are either too short-term oriented or based on methodologies used in entirely different economic environments, rendering their conclusions meaningless.

On the other hand, many banks are not prepared to explore M&A for a myriad of reasons including:

- Concern about the resources required to evaluate M&A transactions and the distraction of senior management time.

- A belief that there are no appropriate targets willing to sell within their targeted territories.

- Concern that transactions are grossly overpriced.

- An inability to quantify the value-add of potential targets as a solution to the upcoming trends and issues because they are using traditional techniques and methodologies.

Given the existing practice and prevailing techniques, these banks are generally correct in their assumptions and fears. Fortunately, there are techniques backed by an appropriate database that can, without distraction and/or commitment of significant resources, allow banks to:

- Comprehensively survey all potential candidates (irrespective of whether they are for sale) within their targeted geographical footprint.

- Evaluate the impact of each of these “theoretical” transactions on their future consolidated performance, taking into consideration the asset mix, rate structures, maturities and amortization schedules of the targets.

- Exploit mutual benefits and vulnerabilities of the target to successfully convince banks to be acquired.

- Fulfill their obligations to directors and shareholders by eliminating or incorporating M&A as a potential strategic solution for upcoming issues.

M&A can be a powerful catalyst to solve problems in today’s complicated banking environment. It does not have to tie up too much bank time or management resources, if it is done correctly with the right analytics and process.

For more information about the Invictus Group’s M&A advisory services, please email manda@invictusgrp.com