Capital & Strategy

Capital planning and strategic planning are two sides of the same coin. The Capital & Strategy slice of the Invictus Capital Stack integrates capital and strategic planning to help banks develop ideas that are comprehensive, compelling, dynamic, and actionable.

Solutions designed to position your institution to capitalize on shifting economic trends.

Invictus’s Capital & Strategy products address regulatory concerns, safely increase your capacity to grow, customize your capital requirements, and even build the critical components of your capital plan.

Increase Your Balance Sheet Capacity

Safely and confidently grow where you want to grow by verifying concentration levels on the InFocus concentration management platform.

Customize Your Capital Requirements

Avoid "rule of thumb" regulatory capital requirements. Set your capital expectations based on your institution's unique risk profile.

Integrate with your

Capital Plan

Planning to grow? Biding your time? One strategy will utilize capital, the other will create it. Use the capital stack to verify any direction.

Trusted by over 100 Banks and Credit Unions

Since 2009, Invictus has been providing capital analysis for institutions across the United Stated. Through the Capital & Strategy portion of the Capital Stack, you can create a defendable, repeatable capital planning process that withstands any scrutiny.

- of Innovation

- 13 Years

- Model Validation Success Rate

- 100%

- Failed Exam Outcomes

- 0

Increase Your Balance Sheet Capacity

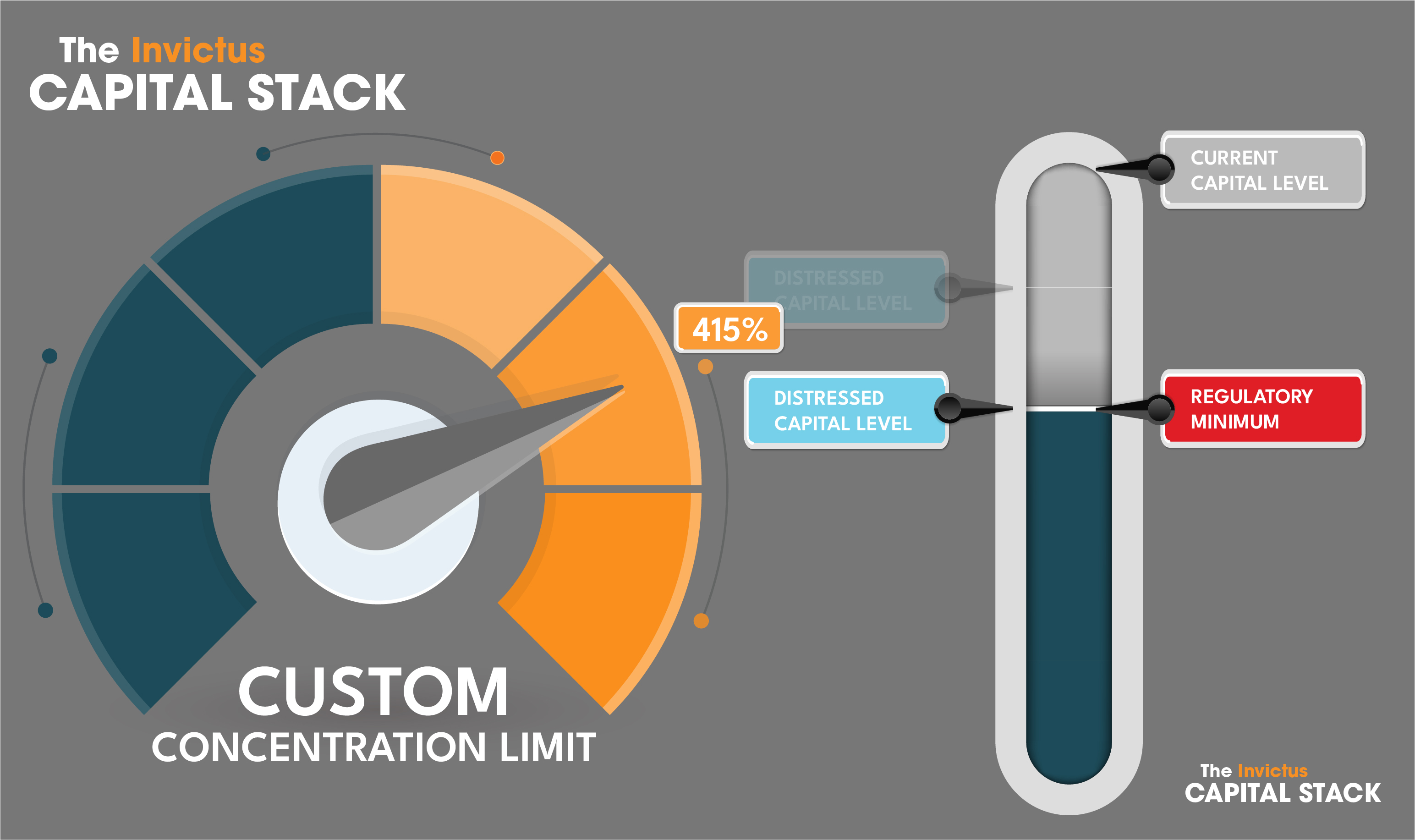

Active Concentration Management allows for banks to dynamically test concentration levels in a series of ‘what-if’ analyses. By simulating growth within certain bank products and testing capital levels, InFocus puts concentration risk management firmly in the bank’s control. Explain your concentration levels and policies to regulators, management, and the board confidently.

Frequently asked questions

-

InFocus was built with this guidance in mind - but also incorporates the most up-to-date regulatory thinking on the topic of concentrations.

-

Bank's with rapid growth are often closely monitored. You should build a concentration risk management framework ASAP to address any questions - both internal and external.

-

Yes - and many banks do. However, risk management should be a forward-looking exercise. When it comes to concentrations, institutions forget that they should be modeling the future growth within their portfolio as well as evaluating their current position.

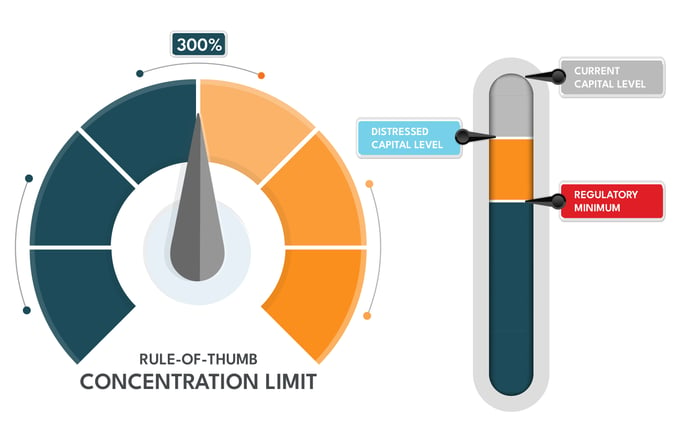

Rule-Of-Thumb Concentration Limit

Most banks will modify their strategy to avoid crossing 300% CRE Concentration - Even at the expense of growth. Often times, they have more than enough capital to keep growing!

Custom Concentration Limit

Utilizing InFocus you can test the maximum level of concentration that your current capital levels can support - enabling you to continue to pursue your growth stategy.

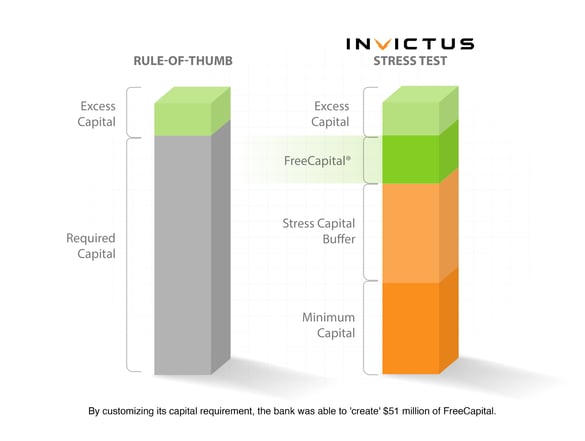

Customize Your Capital Requirements

The larger banks calculate their “Stress Capital Buffer” using the CCAR program every year. You should utilize this framework to your advantage and customize your bank’s capital requirements. Invictus has helped hundreds of institutions regain control of their capital by calculating individual stress capital buffers based on underwriting characteristics and lending practices.

Frequently asked questions

-

No - not necessarily. However, the CBLR can have the unintended consequence of separating your capital requirements from your risk profile.

-

The regulators will often presume that your bank is the 'lowest common denominator' institution and ask you to apply the loss rates from "banks in the 75th percentile." Performing your own analysis gives you the ammunition you need to combat these ideas.

-

Absolutely! One of the major points of the Capital Stack is that everything is integrated - from top to bottom. Your capital requirements should be based on your loans first and foremost.

Integrate with your Capital Plan

Utilize the Capital & Strategy stack to test how your capital plan would behave in a multitude of economic projections ranging from the favorable, to extremely unfavorable. Updating your annual capital plan should be simple, efficient, and flexible. Invictus's Capital & Strategy solutions are built to automatically address the things that regulators expect to see in your capital planning process.

Frequently asked questions

-

Yes. We've built this solution with your capital plan in mind. We've even written draft capital plans for many of our clients. It's never too late energize your capital planning process.

-

Your strategy should be tested in your capital plan. If you're planning to grow in the next year, you should verify that this growth won't place the bank's capital under pressure. This is what the large bank's do in the CCAR Stress Testing process each year and you can do it too.

-

Certainly. We continue to have clients successfully develop new capital plans and improve the one they already have "Capital & Strategy." The key is to avoid the 'black box' problem - which is why we offer unlimited advisory services and transparent modeling.