Loan Portfolio Analytics

Loans are the earnings engine of your bank. The Loan Portfolio Analytics portion of the stack is built to answer critical questions about your loan portfolio - from optimizing your ACL reserve to evaluating loan profitability.

The best way to evaluate your portfolio

If you don't understand the model, you shouldn't use the model. We've built loan portfolio analytics from the ground up to be intuitive, powerful, and flexible.

-

ACL Optimization

-

Many institutions are stuck with CECL solutions that are overly expensive, difficult to deploy, or that they can't customize. We've fixed all of that.

-

Loan Pricing & Profitability

-

Loan pricing is evolving - don't fall behind. Loan portfolio analytics can provide management with effective loan pricing tools to deploy to lending teams. Guide incentives and respond to the dynamic environment.

-

PoWER - Climate Risk

-

Climate Risk is emerging as a major focus area for regulators. Explore possible weather event risks within your loan portfolio and get ahead of the regulatory curve.

-

Integration

-

Your loan portfolio should be evaluated with the same model whether you're focused on the ACL, stress testing, loan pricing, or climate risks. Use the loan portfolio analytics portion of the stack to do it all in one place.

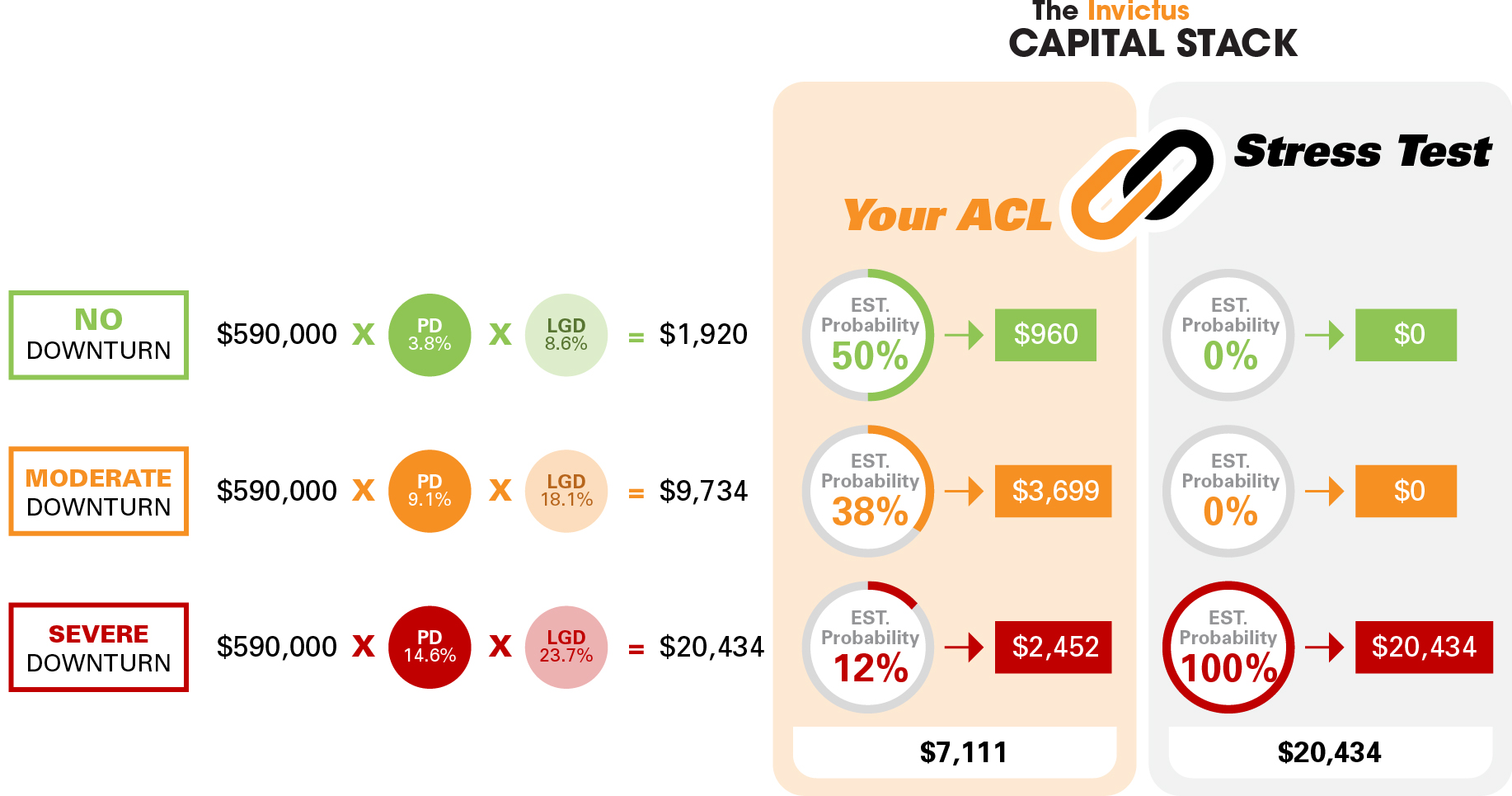

Optimize your ACL, Integrate your Stress Test

Since the onset of the CECL standard, institutions have struggled to implement an effective, repeatable solution that they can understand. Many CECL solutions provide a complex black-box model that do not provide the bank with a concrete understanding of the model's behavior. This creates a uncertainty around results and disallows the CECL model to be used for other critical functions.

The Invictus ACL service provides an open-book approach to CECL. With compelling loan-level ACL results that you can easily recreate yourself. With this deep understanding of the model's capabilities we can begin to integrate the ACL model into other critical functions found throughout the Capital Stack.

You Stress Testing and CECL models can and should be fully integrated!

An Integrated CECL Framework

Once you understand the model - the applications become virtually endless. An effective ACL model can support all levels of the stack from loan pricing and profitability to capital and strategic planning.

Frequently asked questions

-

Absolutely. Invictus has several clients who are "CECL-Live" and have successfully implemented validation frameworks around our ACL model.

-

Switching a CECL framework can be tricky - but it certainly isn't impossible. Many of institutions have swapped to our model after having valid but disappointing implementations. If you're interested in extracting more from your CECL model, we'd love to chat.

-

Don't worry - most banks don't. That's why our solution includes unlimited consulting and implementation support to help you along the path of full integration. Our success depends on your success.

Understand Loan Profitability - Integrate Your Pricing

Loan profitability has changed in the modern era. Bank's focused on data and detail will deploy more effective pricing strategies and ultimately increase their profitability. The Invictus loan profitability approach incorporates each level of the capital stack from your ACL results, to the macro-economic environment, to specific underwriting characteristics. Use the pricing tool to evaluate loans before they're on your balance sheet and maintain your competitive edge by re-evaluating relationship profitability on an ongoing basis.

Frequently asked questions

-

It can be a slight culture shift to move to a pricing model, but it is important to recognize that the pricing model is designed to enable your lenders - not limit them.

-

It is true that models are not perfect. The Invictus pricing model is the first to integrate other critical bank functions into the pricing decision - but may not include every factor. This is why we make the deepest darkest corners of the model readily available for you to understand. That's the only way you can decide on the correct implementation of the pricing model.

-

Yes. Funds Transfer Pricing is a critical component of the pricing model and can be customized to fit the bank's specific need.

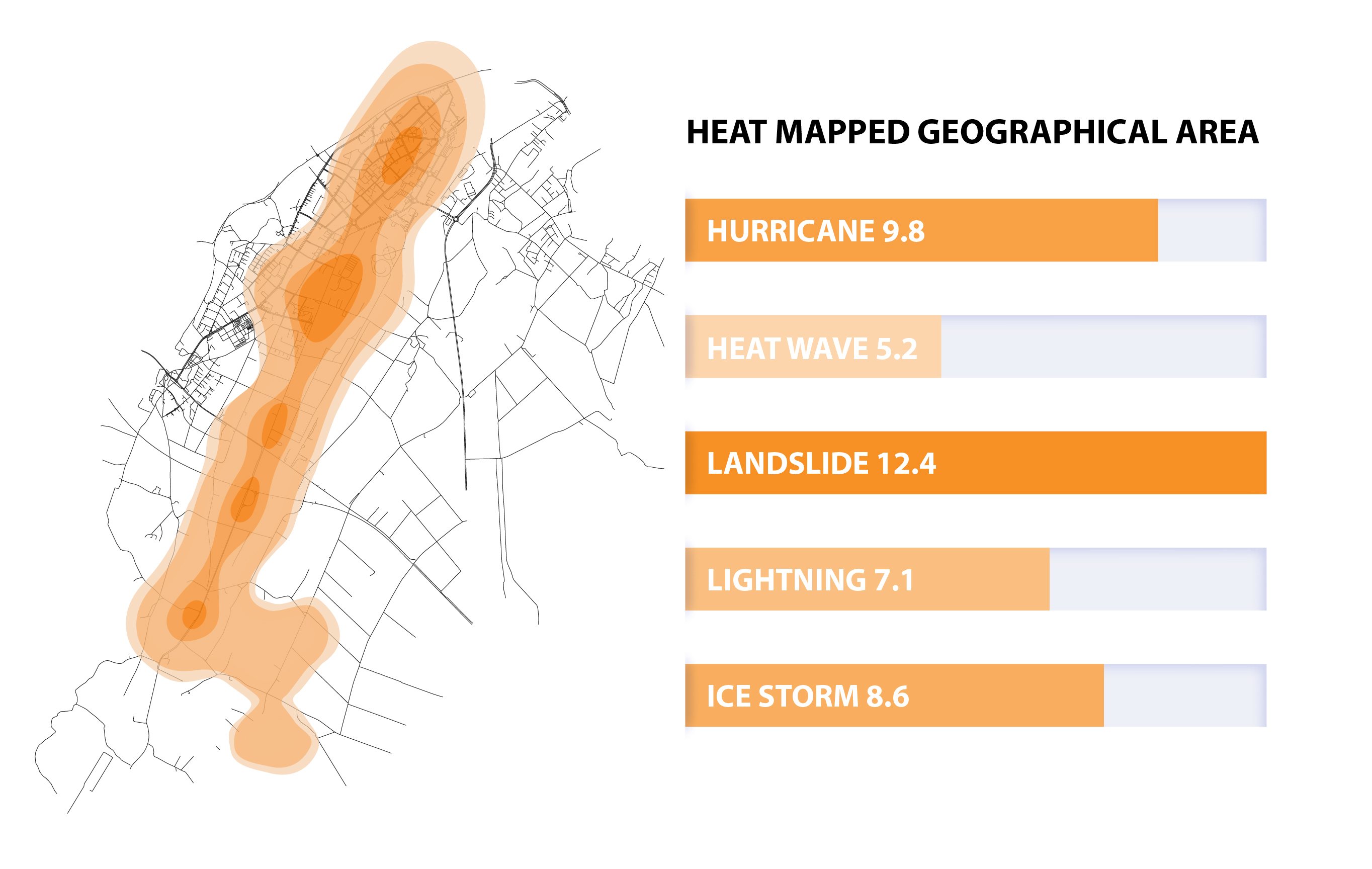

PoWER™ - Weather Event Risk

This simple suite of climate risk analytics provides a perfect starting point for Community Banks to begin understanding their exposure to possible weather events related to climate change. Focusing on "physical risk" this tool will allow you to have meaningful discussions with bank examiners and within the board room.

Using loan-level data, the Portfolio Weather Event Risk (PoWER)™ analysis maps specific climate risks to your geographic markets and provides a visual representation of possible "physical risks" allowing anyone to understand the bank's potential exposure and providing for an avenue to manage it.

Frequently asked questions

-

Bank regulators expect banks of all sizes to begin understanding their climate risks. This system is designed to help set the regulatory agenda for community and regional banks. It enables banks to quickly show examiners, boards, and investors a visual portrait of the climate risks in your portfolio and footprint.

-

This tool allows you to better understand your bank's exposure to extreme weather events and natural hazards. You can use this information to inform your lending practices and strategic decision making to better account for unseen risk as well as hidden opportunity.

-

You can use the reports from this system to help craft your climate disclosures - particularly pertaining to the bank's exposures stemming from extreme weather events. We're always monitoring what larger institutions are expected to do and strive to capture this kind of information within PoWER™.