The Invictus Partner Program ensures that you will get unlimited consulting support for any of your capital stress testing questions. With the Invictus Capital Stress Testing service, our analysts are your analysts.

Make no mistake about it: Bank regulators, members of Congress, and other financial overseers are concerned about the impact of climate change on banks of all sizes. And they want banks to do something about it.

This simple suite of climate risk analytics provides a perfect starting point for Community Banks to begin understanding their exposure to possible weather events related to climate change. Focusing on "physical risk" this tool will allow you to have meaningful discussions with bank examiners and within the board room.

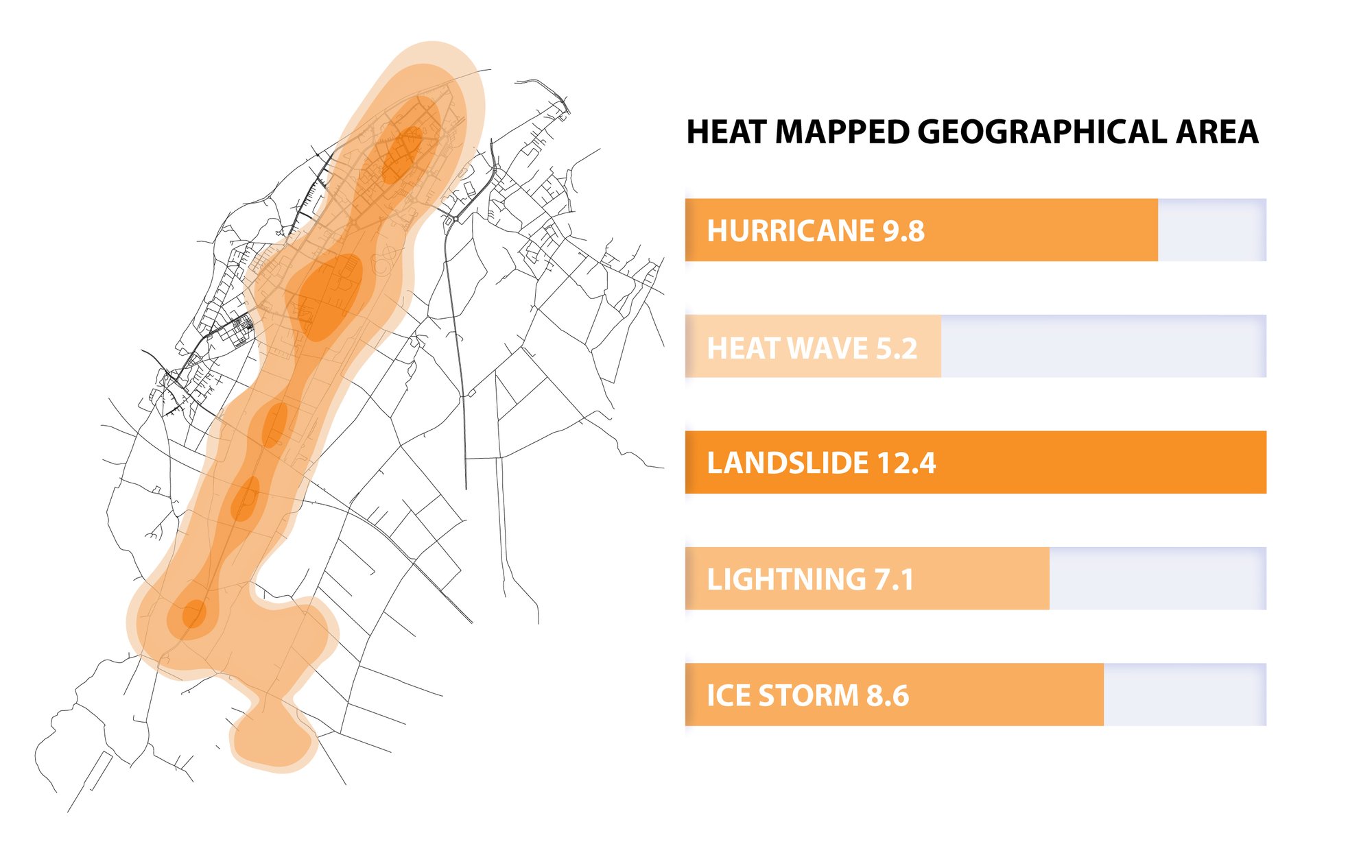

Using loan-level data, the Portfolio Weather Event Risk (PoWER)™ analysis maps specific climate risks to your geographic markets and provides a visual representation of possible "physical risks" allowing anyone to understand the bank's potential exposure and providing for an avenue to manage it.

PoWER National Risk Index

The regulatory pressure on community banks to show they understand how climate change will affect their banks is only going to increase in the years ahead.

Download the Free White Paper

The Regulatory Push for Community Bank Climate Change Risk Management

Watch our video.

The regulatory pressure on community banks to show they understand how climate change will affect their banks is only going to increase in the years ahead. Although regulators are focusing first on the largest, systemically important banks, they have made it clear that the issue will “trickle down” to community banks. Our white paper explores the state of climate risk regulation and gives community banks a road map for how to get ready for climate change risk management before it is mandated.

Our Expertise

Invictus has over 50 years of combined expertise helping community banks - let us put that experience to work for you:

Adam Mustafa

President & CEO

Guy LeBlanc

President, BankGenome Analytics

Frequently asked questions

-

Currently, most institutions are not required to perform extensive climate risk analysis on their portfolio and/or footprint. However, prudent institutions are preparing for a coming wave of climate-related risk regulation. PoWER is a great first step.

Further Reading

Crop Insurance Trends in the US: An application of Invictus PoWER Analytics tool

Assessing Drought Risk in Mississippi: Introducing PoWER™ Climate Risk Analytics for Community Banks

Drought conditions in Mississippi have become a growing concern, affecting various aspects of the state's economy and environment.

ACTION REQUIRED: Transition Risks in the Face of Climate Change

As global greenhouse gas emissions soar to unprecedented levels and the world grapples with the urgent need to address smoking skies, the implications for financial institutions, including community banks, cannot be ignored.