We Do M&A Differently

Essential analytics and customized proactive targeting

We use proprietary strategic intelligence to unlock unique growth opportunities for your bank.

Invictus customizes the M&A process for your bank. We find the right target and help create the deal.

Every bank is different. Each has its own industry-focused footprint and unique asset and liability composition that must be quantified. We use the BankGenome™ system to:

-

Evaluate all banks within management-defined markets, measuring their value proposition for your bank.

-

Quantify the relative impact on your bank’s shareholder value of acquiring each target versus organic growth.

-

Analyze each transaction’s value components – loans, deposits, securities, and more – rather than using extrapolated financial statements and generalized rules-of-thumb like multiple-of-book and payback periods.

-

Utilize the Invictus industry-leading capital adequacy models to ensure capital adequacy and regulatory communications.

-

Exploit inconsistencies in present market pricing techniques to your bank’s advantage.

-

Dramatically reduce senior management time and resource commitment with accurate, realistic loan-level pro forma modeling.

-

Use the results to customize the approach to the targets that make strategic sense and help you close the deal. Invictus created and closed seven non-auction deals in 2017 and 2018.

A Sample of Invictus M&A Intelligence

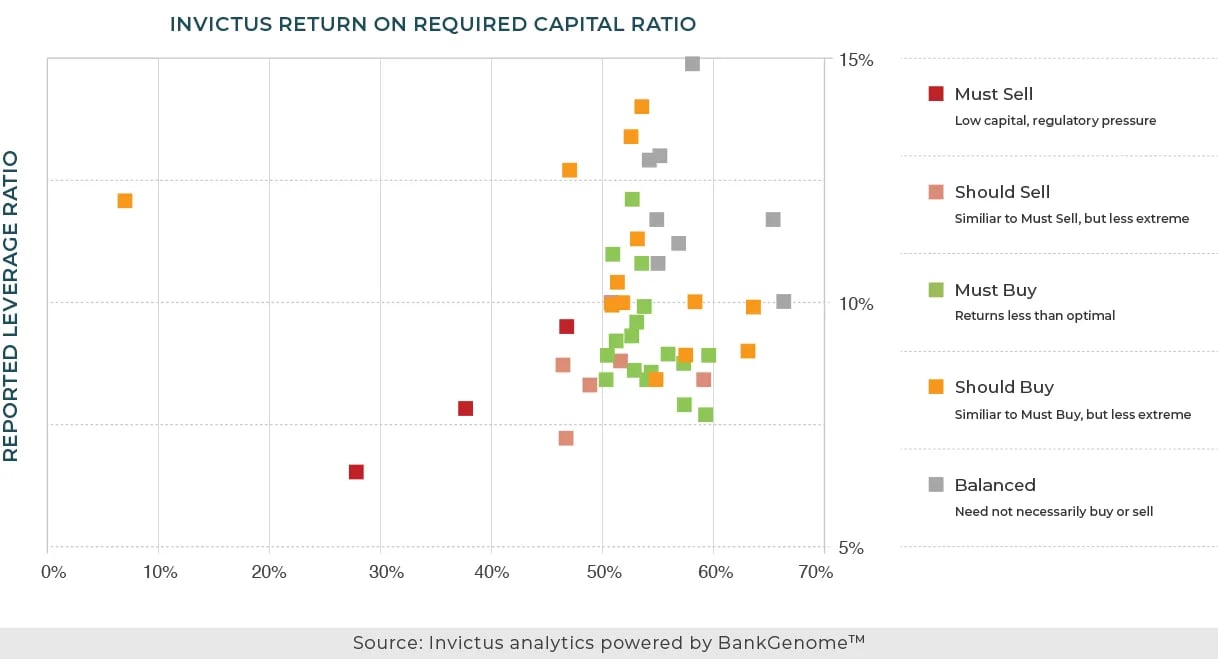

SAMPLE 1: Invictus Capital Efficiency Radar

Banks within 100 miles of client identified as likely M&A targets based on level of available capital and region.

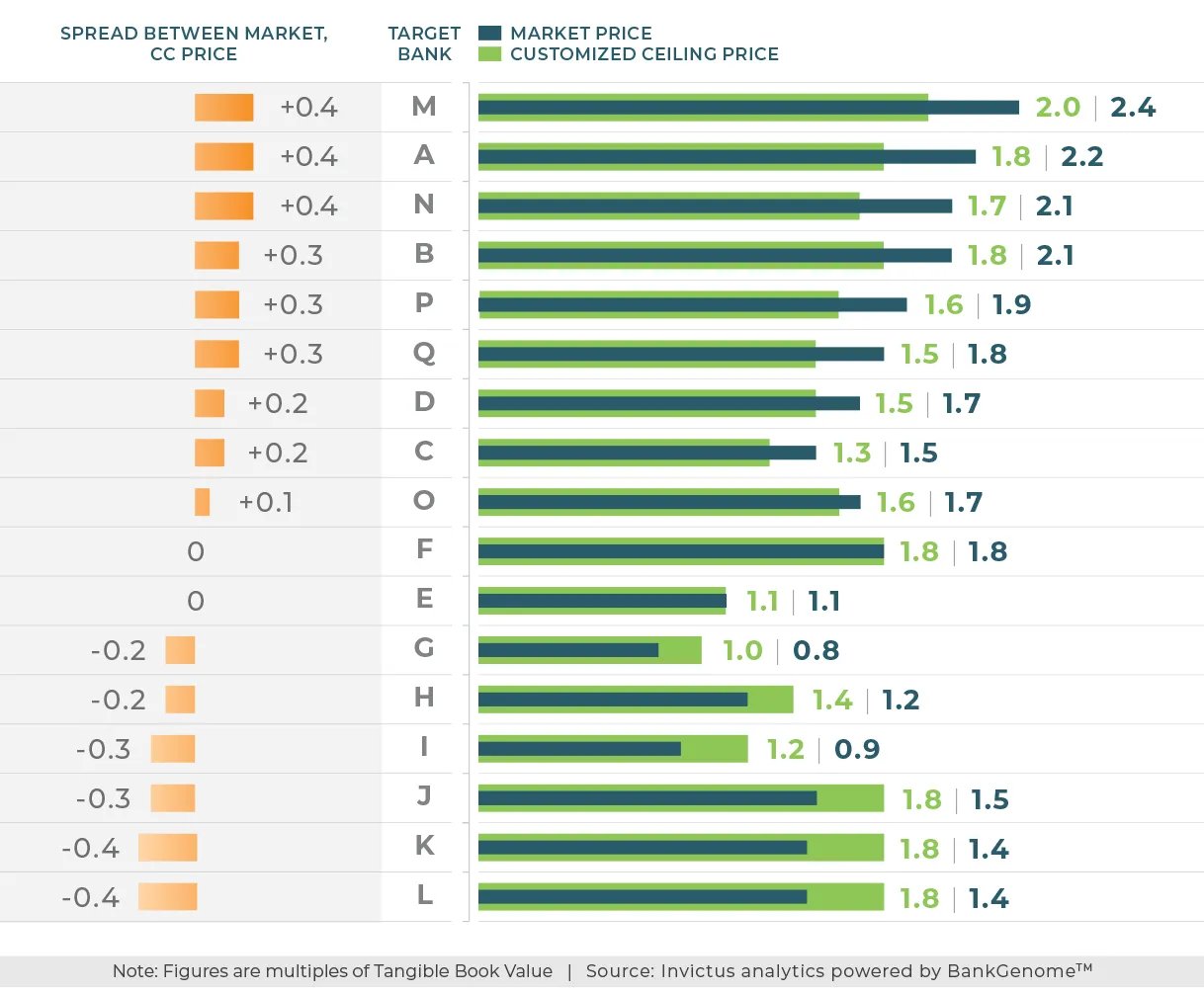

SAMPLE 2: The Invictus Pricing Advantage

Every bank for sale has a different value proposition for each individual buyer. Invictus calculates the ceiling price a bank should pay for every target, giving banks a competitive advantage and allowing them to exploit differences between that price and the going market rate.

Read more about the Invictus approach in this presentation .

We do M&A differently because we have proprietary analytics.

-

We reveal hidden value and risk within acquisition targets.

-

If a deal doesn’t make sense for your bank, we tell you when to walk away.

-

We sort every bank in the country to define the M&A landscape.

Our M&A team includes strategists, analysts, investigators and former bank CEOs. The team is led by Invictus Chairman Kamal Mustafa, former head of global M&A at Citibank, Invictus president Adam Mustafa, and M&A Director Andrew O’Keefe. Everything we do is backed by an exclusive database and differentiated analytics, powered by BankGenome™. Our goal is to maximize shareholder value. We consider the impact of an M&A transaction on every aspect of your bank’s strategic plans.