Invictus Tariff and Trade War Recession Scenario

The Invictus Tariff and Trade War Recession 2.0 scenario (updated August 19, 2025) is intended to reflect (but not predict) a tail-risk outcome for the U.S. economy, driven by...

The Invictus Partner Program ensures that you will get unlimited consulting support for any of your capital stress testing questions. With the Invictus Capital Stress Testing service, our analysts are your analysts.

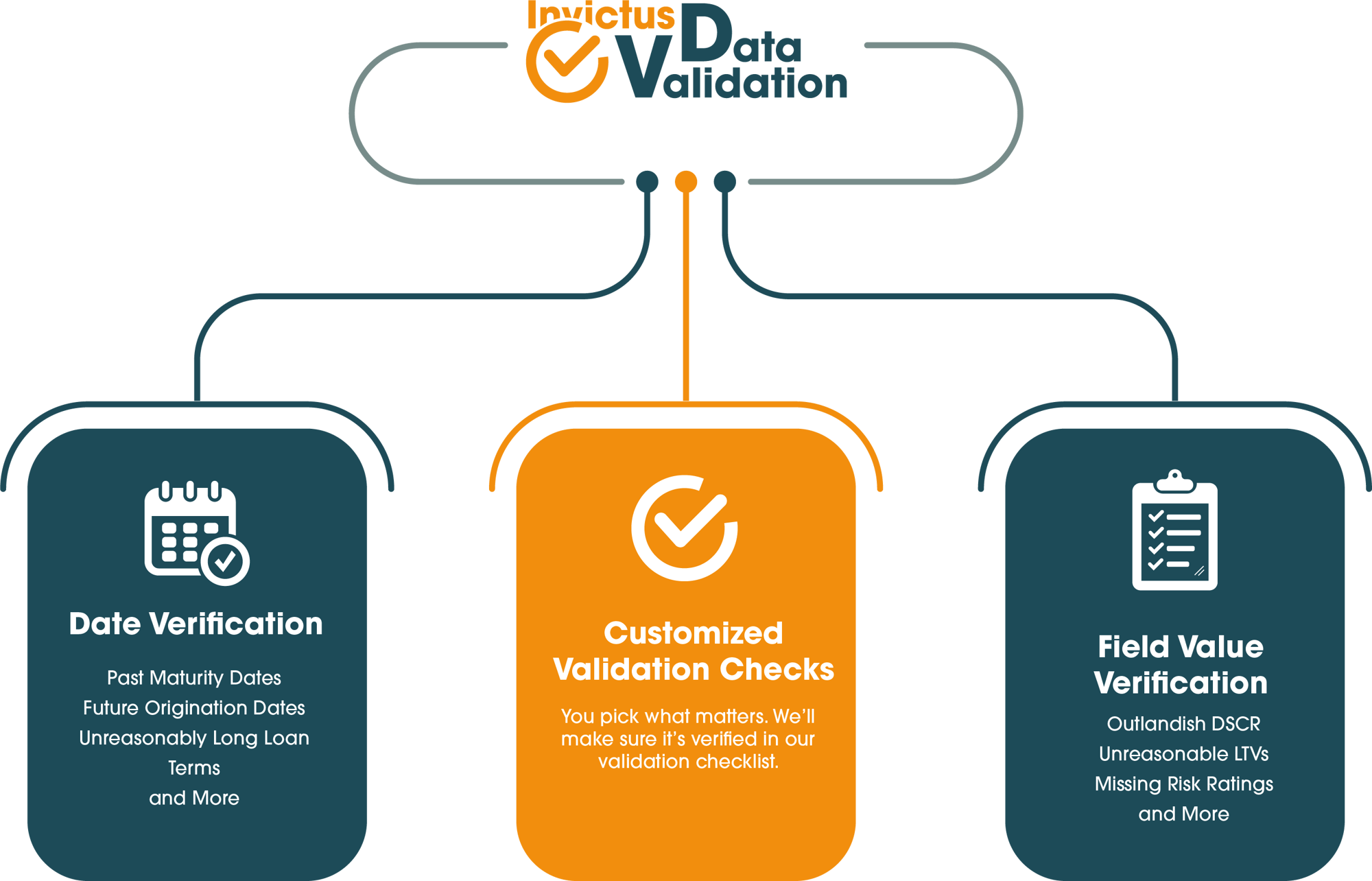

Ensure the accuracy and reliability of your financial data with our advanced data validation service. Designed to catch critical errors and inconsistencies, our solution pushes your data to the highest standards of quality, allowing you to confidently leverage it for various analytical and compliance purposes.

Our data validation service meticulously checks for critical mistakes such as inconsistent dates, unreasonable ranges (e.g., LTV ratios), and numerous other potential issues. Whether you're using our firm's services—like stress testing, CECL, and loan pricing—or need your data validated for use with other vendors, our solution ensures your data is accurate, reliable, and ready for analysis.

Ready to elevate the quality of your financial data? Contact us today to learn how our validation service can enhance your data accuracy and support your analytical needs. Let us help you unlock the full potential of your data.

Catches a wide range of data errors, from date inconsistencies to out-of-range values.

Use our validation service for our analytical services or with other vendors.

Ensures your data is accurate and reliable, enhancing the quality of your analysis.

Identifies and corrects errors early, saving you time and reducing potential risks.

Our validation service stands out due to its integration with our other products and its flexibility to support third-party solutions. By ensuring data integrity, our service enhances the performance of our offerings like stress testing, CECL, and loan pricing. Additionally, it is versatile enough to validate data for use with any other vendor. By identifying and correcting errors before they become issues, our solution saves you time, reduces risk, and enhances the overall quality of your data.

Don't let data errors compromise your financial analyses and decision-making. Take control of your data accuracy and reliability, and ensure your institution operates with the highest standards of precision and confidence.

Invictus has over 50 years of combined expertise in the area of capital stress testing - let us put that experience to work for you:

Adam Mustafa

President & CEO

Guy LeBlanc

President, BankGenome Analytics

Absolutely. While the data validation service was built to increase the quality of loan data used in our own solutions, you can use our data validation services to prevent the "GIGO" problem with any of your vendors.

No. Many of our clients provide us with spreadsheet data files that we process through our validation software. We'll work with whatever source of data you have.

I don't know, but the flag is a big plus. Lorem ipsum dolor sit amet consectetur adipisicing elit. Quas cupiditate laboriosam fugiat.

CECL Trends, CECL, community bank regulations, community banks, CECL Modeling, acl challenges, bank regulatory compliance, advanced cecl

Now that most community banks have eight to ten quarters of CECL experience under their belts, many are still grappling with foundational issues such as overreliance on qualitative factors, lack of responsiveness to risk rating...

capital planning, community bank regulations, Deregulation, bank strategy, community banks, regulatory capital, bank growth strategy, cre risk

Author : Adam Mustafa, CEO, Invictus Analytics

Community banks now have the clearest path in nearly two decades to reshape their regulatory capital requirements—and they shouldn't miss it. While most recent efforts to ease...