The Invictus Partner Program ensures that you will get unlimited consulting support for any of your capital stress testing questions. With the Invictus Capital Stress Testing service, our analysts are your analysts.

Concentration Management - InFocus™

InFocus is designed to link loan concentration management with other risk management practices - in particular capital planning, loan level stress testing, and capital stress testing.

Why InFocus?

Loan concentration policies are often a source of pain for bank management. They serve as the 'bumpers' against aggressive growth - and that can make them unpopular. InFocus will allow you to link your concentration policies with your underwriting and capital profiles. It is completely customized to your institution.

Get a Free Concentration Risk Assessment! See how your concentrations compare to your peer group, how you rank nationally, and what the likelihood of enhanced regulatory scrutiny might be.

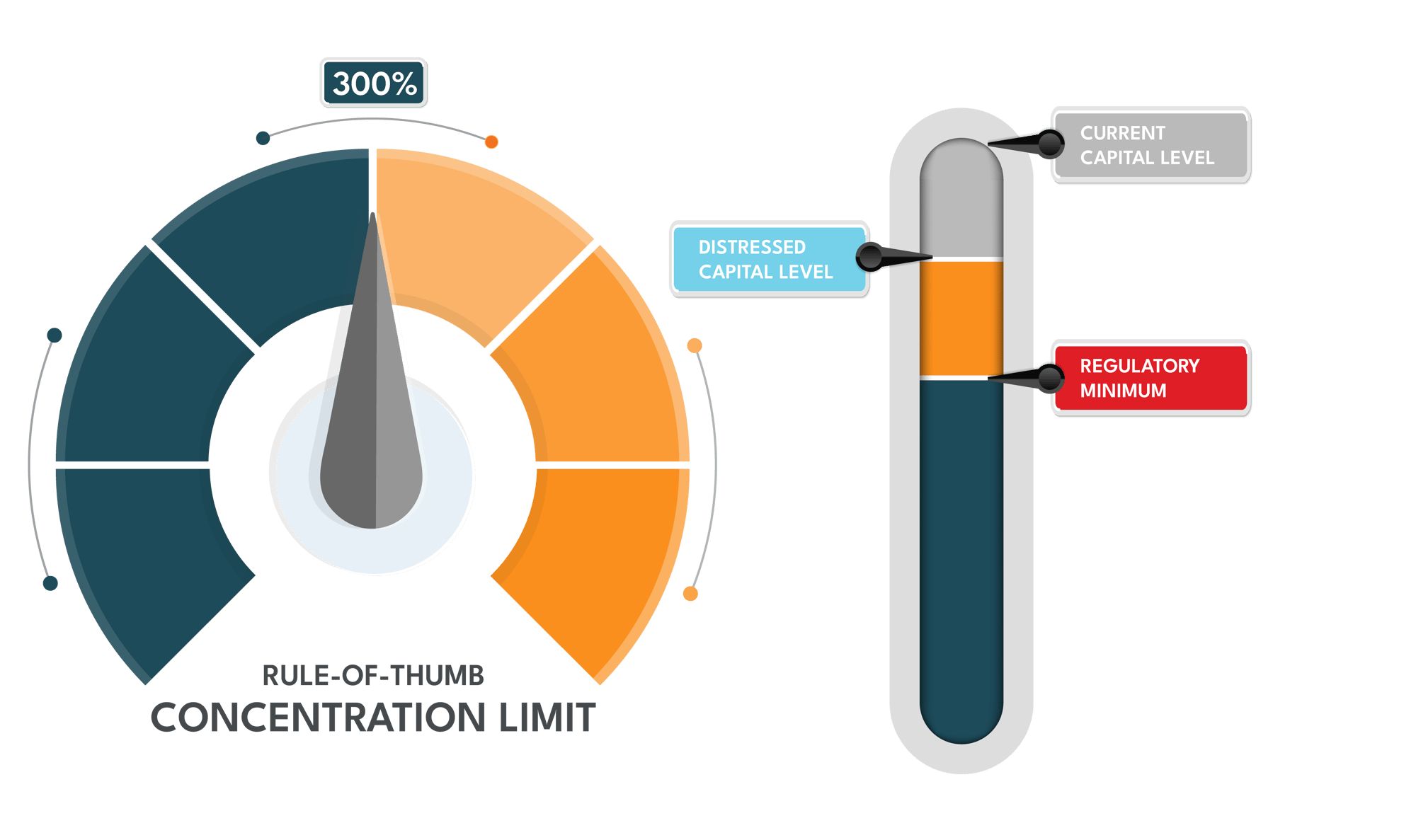

300% - Rule of Thumb

The most commonly cited concentration 'threshold' is the 300% CRE Concentration level. This level is often used as a standard threshold for 'too much risk.' But this arbitrary level does not consider your institution's capital profile or underwriting.

InFocus - Customized Concentration

With InFocus, we can use the loan level and capital stress testing to customize your maximum concentration level. We ask the question: at what level of concentration does your institutions fail to survive in a severely distressed environment. The answer to this question is your maximum concentration level.

Test Any Time

You can access your concentration management system any time. 24 hours a day 365 days a year. Test new concentration policies as you modify your strategy, or update your capital plan.

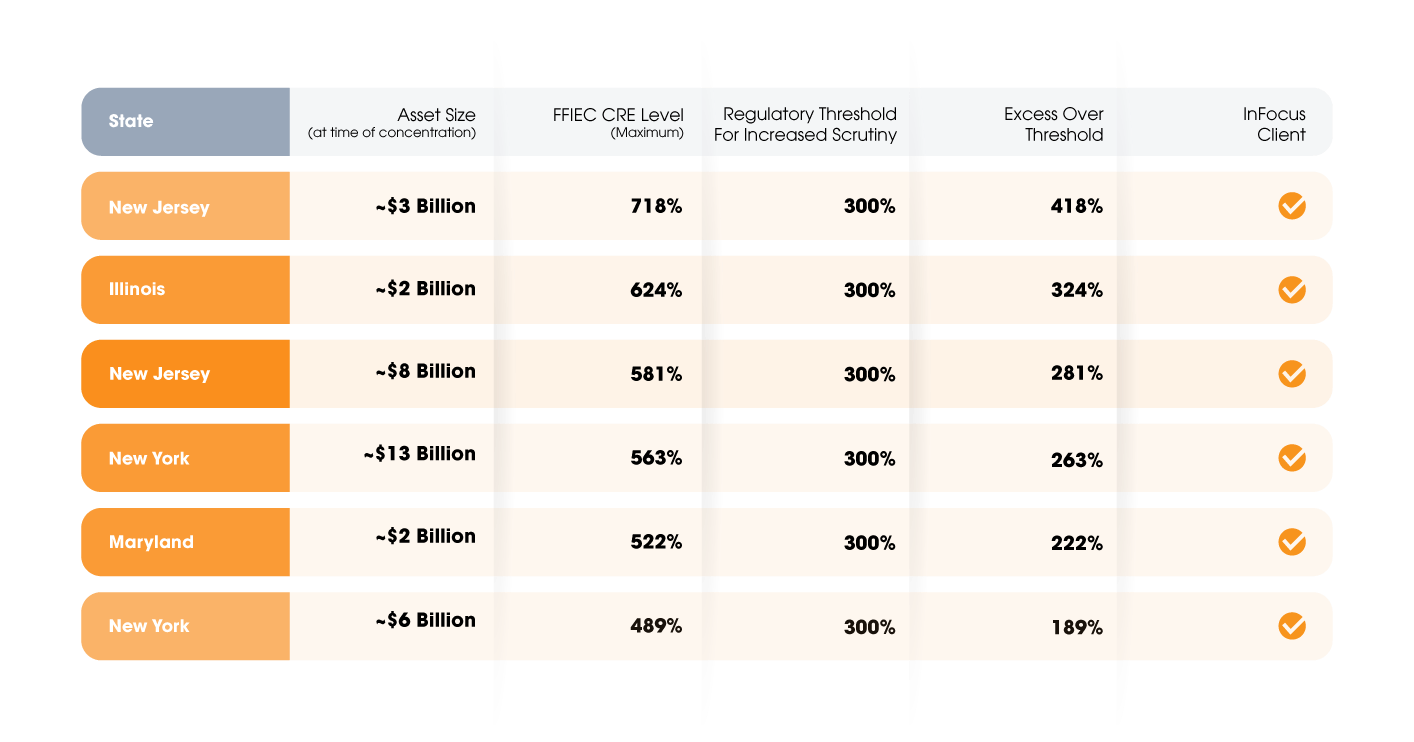

Check out who we've helped

InFocus has been used by institutions with concentration levels far above the 300% level to help manage concentration risk and defend their existing concentration levels.

Our Expertise

Invictus has over 50 years of combined expertise in the area of capital stress testing - let us put that experience to work for you:

Adam Mustafa

President & CEO

Guy LeBlanc

President, BankGenome Analytics

Frequently asked questions

-

InFocus was built with this guidance in mind - but also incorporates the most up-to-date thinking on the topic of concentrations.

-

Banks with rapid growth are often closely monitored. You should build a concentration risk management framework ASAP to address and question - both internal and external.

-

Yes - and many institutions do. However, risk management should be a forward-looking exercise. When it comes to concentrations, institutions forget that they should be modeling the future growth of their portfolio as well as evaluating their current position.

Further Reading

Get Ready for Tough Concentration Questions at your Next Bank Exam

What Every Community Bank with a CRE Concentration Needs to Do Before March

If you work for a bank that has a CRE or construction concentration, you most likely know that regulators have you in their cross hairs.

Ten Questions that Banks with High CRE Concentrations Should Answer

First it was the FDIC, which put community banks with CRE concentrations in its crosshairs when the supervisory division released its update on commercial real estate concerns in Supervisory Insights in early August.