The Invictus Partner Program ensures that you will get unlimited consulting support for any of your capital stress testing questions. With the Invictus Capital Stress Testing service, our analysts are your analysts.

Loan-Level Stress Testing

Every financial institution must integrate loan-level stress testing into its risk management framework as an essential component. While not mandatory for all institutions, engaging in loan-level stress testing remains pivotal for effective risk mitigation. Invictus's comprehensive stress testing delves into the strengths and potential weaknesses of your portfolio, meticulously examining various elements of credit risk often overlooked by institutions, such as vintage, loan structure, borrower industry, and more.

Loan Stress Testing with Invictus

A stress test differs from an underwriting shock; it's a forward-looking estimation of unexpected losses in adverse environments. Invictus employs the "CCAR Framework" used by the Federal Reserve with the nation's largest institutions to evaluate the risk in your loan portfolio. If it meets their standards, it's a robust choice for your risk assessment needs.

No Commitment - Get started with Invictus

Unlock the value of your portfolio with a complimentary loan-level stress testing analysis for select loans! Explore valuable insights without any cost, allowing you to make informed decisions about your assets.

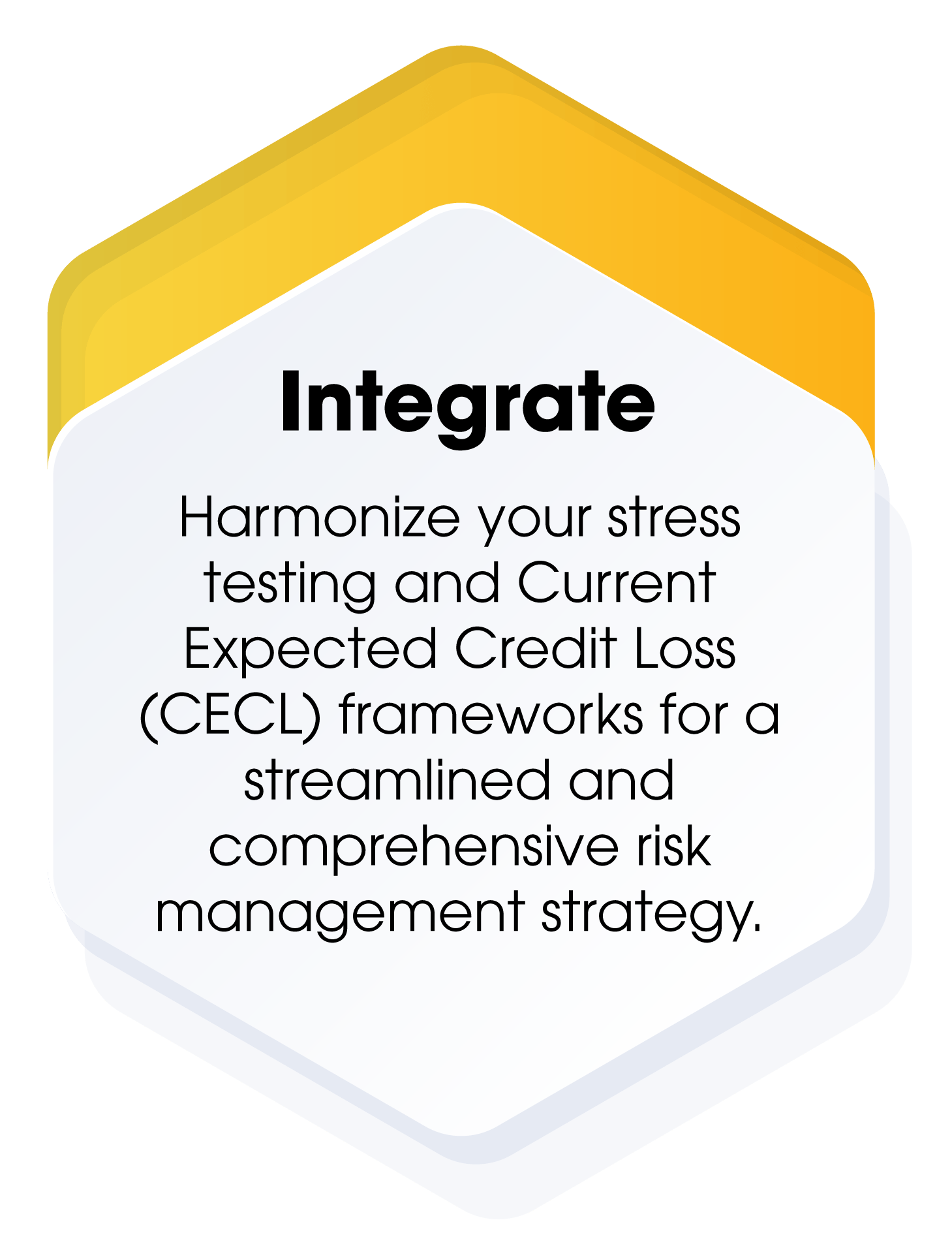

Ensure a close alignment between your Loan Loss Reserve and stress testing framework. Consider your loan-level stress test as an estimation of the reserve in the context of a predefined economic downturn. This integration enhances the effectiveness of your risk management approach, tying the reserve directly to the insights gained from stress testing.

Get a Stress Test Quote

Our stress tests are competitively priced for the community banking market. While we apply a 'big bank' approach, our pricing remains accessible and does not reflect 'big bank' rates.

Let's find a pricing solution that fits your needs.

Our Expertise

Invictus has over 50 years of combined expertise in the area of capital stress testing - let us put that experience to work for you:

Adam Mustafa

President & CEO

Guy LeBlanc

President, BankGenome Analytics

Frequently asked questions

-

This question often causes confusion in banks. A sensitivity test usually assesses specific shocks to underwriting, such as decreasing Net Operating Income (NOI) levels or increasing capitalization rates. In contrast, stress testing involves defining a plausible external scenario applied to the institution's entire portfolio.

-

While it is undeniably challenging, conducting meaningful stress analysis with limited data is not impossible. With fundamental information such as origination dates, maturity dates, risk ratings, and interest rates, it is possible to complete a stress test. While more specific data would enhance the results, even basic information can yield valuable insights.

-

Every single one of your loans should be included in a comprehensive stress testing framework, regardless of perceived risk levels. A thorough approach ensures a more robust risk assessment and better prepares for unexpected scenarios.

Further Reading

Navigating the Shifting Landscape: Addressing Concerns in Commercial Real Estate

Get Ready for Tough Concentration Questions at your Next Bank Exam

No matter the regulator, community banks with concentration issues should expect extra scrutiny at their next exam.

Ten Questions that Banks with High CRE Concentrations Should Answer

We can now officially add the OCC to the list of regulatory agencies that have fired a warning shot at community banks with CRE concentrations.