The Invictus Partner Program ensures that you will get unlimited consulting support for any of your capital stress testing questions. With the Invictus Capital Stress Testing service, our analysts are your analysts.

Liquidity Analysis

"Big Bank" liquidity analysis built for Community Bankers.

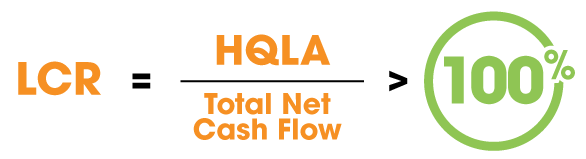

Hold your liquidity to the highest standard -deploy the Liquidity Coverage Ratio (LCR) test.

On balance sheet liquidity is king in the modern era. Get ahead of the regulatory pressure and test your bank against the framework used by the largest financial institutions in the world.

This product will:

-

Allow management to construct strategies that insulate the bank from liquidity risks.

-

Focus on the structure, composition, and maturity spectrum of the investment portfolio.

-

Outline the impact of deposit types, maturities, and customer types on the bank's liquidity position in the event of a short-term liquidity crunch.

Liquidity Risk should be at the heart of your bank’s risk management framework.

Time and again we see institutions with strong business models and powerful earnings profiles collapse under the immense gravity of liquidity crises. In post-mortem regulatory analysis we find that many of these institutions either:

Fail to address liquidity shortfalls highlighted by their existing liquidity risk management practices

or

Performed ineffective liquidity analysis techniques.

The regulatory landscape is sloping towards “on balance sheet” liquidity resources as opposed to relying on available credit lines. Invictus constructs a modified liquidity coverage ratio to provide management with both strategic and tactical information for liquidity purposes. As your partner, we will challenge management to objectively evaluate and address existing and future liquidity risks.

Invictus’s liquidity risk management service provides:

-

In-Depth Advisory support

-

LCR results summary

-

Detailed breakdown of liquidity test and results

Our Expertise

Invictus has over 50 years of combined expertise in the area of capital stress testing - let us put that experience to work for you:

Leonard J. DeRoma

Chief Financial Officer and Director of Liquidity Analytics

Guy LeBlanc

President, BankGenome Analytics

Frequently asked questions

-

The Liquidity Coverage Ratio (LCR) is a regulatory requirement introduced after the financial crisis to ensure that banks maintain an adequate level of high-quality liquid assets to cover their short-term liquidity needs. It is a key component of the Basel III framework.

-

While only required of the largest banks, compliance with the Liquidity Coverage Ratio affects a bank's daily operations and strategic planning by influencing its asset composition and funding structure. For community banks, the LCR can assist the bank in assessing risk and preparing for a highly volatile liquidity environment.

-

Community banks often face challenges in maintaining the required levels of high-quality liquid assets while balancing the need for profitability. Banks need to identify suitable liquid assets, diversification strategies, and manage the trade-off between liquidity and yield. Banks may seek advice on best practices for stress testing, contingency planning, and the development of robust liquidity risk management frameworks to ensure compliance with LCR while fostering sustainable growth.

Further Reading

The Biggest Threat to Banks Right Now!

QT is the Federal Reserve's strategy to reduce its balance sheet, and it's far from innocuous. It has a direct impact on our industry, and we need to understand why.

7 SVB Failure Community Bank Ramifications: Liquidity is Now King

Every bank needs to reassess to their strategic and capital plans because of this past week’s events. Optimizing self-sustaining liquidity levels and real capital levels should be the highest priority right now.

11 Observations from the Regulatory Exam Trenches

As expected, regulators have become far more aggressive with community banks. Below are some of our observations...